The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More »The EU and Turkey: Unvarnished Truth and Stuffing

Summary Turkey and the EU will begin negotiations over financial and budget reform. It is one of 35 areas (chapters) of negotiations. Turkey is no where close to joining the EU, for which it initially applied in 1987. In the vitriolic debate over the UK’s membership of the EU, Turkey’s potential membership became one of the talking points. Prime Minister Cameron, who has advocated Turkey’s eventual membership,...

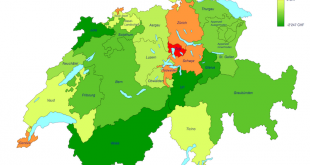

Read More »Swiss tax redistribution in 2017 – winners and losers

Swiss cantons have very different tax bases, tax rates and costs. To even things up, and temper tax rate competition between cantons that jockey to attract the wealthiest residents with the lowest tax rates, Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons. Yesterday, the Swiss federal government...

Read More »As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

Anyone wondering why gaps and volatility in FX, and especially cable is reaching on the absured today, with 100 pips swings in minutes the norm, the reason is that there is virtually no liquidity, and a main catalyst for this is that as HFTs conduct their usual stop hunts to stop out proximal limit orders, they simply find no such stops. They can blame banks such as Barclays for this development: as of 600 GMT...

Read More »Cool Video: Chandler at CNBC on Brexit

Click to see the video. I had the privilege to be on CNBC’s Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week’s lows. This makes us wary of the risk that...

Read More »British Discontent About The EU: Only A Precursor To Unrest On The Continent

Authored by Peter Cleppe, originally posted at Euro Insight, If Brexit marks the beginning of the end for the European project, Brussels will take its share of the blame If Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »Who Is The “European Movement” And Why The Answer May Change How You Vote On “Brexit”

Werner’s main points: The “EU Movement” has been created by the US Government and their secret services in order centralise their influence over Europe. Big business, banks, central banks and the IMF want to excercise their power through unelected officials. The free trade area with the EU is beneficial and will surely be maintained, even in the Brexit case. The election outcome is not so clear as it seems to the...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More »World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2. That’s because this is where every other month the world’s central bankers meet in complete secrecy – no minutes are ever kept – to discuss the global economy completely unfettered of any concerns of accountability, and decide on what monetary policies they will implement to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org