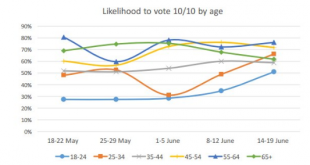

Summary Younger voters are more supportive of the EU. There has been an increase in the intention of younger cohorts to vote. There has been a decline in the intention of some older cohorts to vote. We showed that younger age cohorts in the UK are more inclined to vote to stay in the EU than their elders. However, some suggested that this consideration is blunted by the fact that the younger people are less...

Read More »FX Daily, June 21: CHF Strongest Currency Again

Swiss Franc The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons: Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT (see below) The German ZEW (see below) that was better than expected. We know that CHF acts as a proxy for the German economy via strong trade ties and the tradition that German...

Read More »Towards Freedom: Will The UK Write History?

Summary: Every freedom loving person on the planet has their eyes fixed on this referendum. A clear majority voting for Brexit and therefore for more decentralization, would show that the British realized they can break free from their self-imposed nonage, and reclaim individual liberty. Mutating Promises We are less than one week away from the EU referendum, the moment when the British people will be called upon...

Read More »The Fed Doomsday Device

Summary: Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. Bezzle BALTIMORE – ...

Read More »China the lender of last resort for many oil producers

Summary: Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs. It took a while to play through, but our assessment that China would increasingly become the petro-state lender of last resort is starting to come good. The...

Read More »European Politics Beyond the UK Referendum

Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. Italy’s run-off for local elections was held over the past...

Read More »Great Graphic: Age and Brexit

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a vote to leave the EU. The Great Graphic here was posted on Business Insider,...

Read More »Money Supply Arguments Are Flawed

It goes without question, among economists of the central planning mindset, that if a central bank can just set the right quantity of dollars[1], then the price level, GDP, unemployment, and everything else will be right at the Goldilocks Optimum. One such approach that has become popular in recent years is nominal GDP targeting. How does a central bank affect the quantity of dollars? In discussing a nominal income...

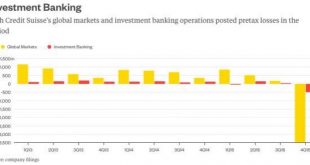

Read More »Why An Ex-Credit Suisse Banker In Brazil Made More Money Than The CEO

Ever had to testify in a trial involving your father’s dealings in corrupt activities, and as a result had your tax records leaked for all of the public to see? Sergio Machado, the ex-head of Credit Suisse’s Brazil fixed-income business has, and now everyone knows how much he made in 2015. Sergio’s father, who goes by the same name, is a former Brazilian politician who went on to head the state run oil company...

Read More »Soft and Softer Silver Fundamentals

It was just a thought…. Cartoon by Bob Rich Loose Monetary Policy Remains in Place Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24. This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org