Summary Sterling falls through last week’s low. Spanish election results suggest a UK is not necessarily a harbinger to anti-globalization forces. Yuan sells off and China breaks diplomatic contact with Taiwan. FX Rates Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to...

Read More »UK Seeks Divorce, Rajoy Needs a Shotgun Marriage

Summary Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner. The UK has decided to seek a divorce from the EU after a 43-year rocky marriage. It was not an overwhelming decision. Brexit won by 52%-48% margin, seemingly too small for such a momentous decision. The UK has not decided exactly when it will formally begin the divorce proceedings, and it wants to be...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or something to that effect. Certainly, this makes for a good bumper sticker. Perhaps it’s a helpful quote for the first time marathon runner to repeat come mile 20. Saying it aloud...

Read More »Another Sexual Assault Gets Refugees Banned From Pools In Austria

Authorities in the Austrian town of Mistelbach issued a temporary pool ban for refugees following a sexual assault by a “dark-skinned’ man on a 13-year-old girl. German and Swiss are issuing leaflets how to behave in pools. Earlier this year we reported that a town in Germany had banned adult male asylum seekers from the public pool after receiving complaints that some women were sexually harassed. As a result,...

Read More »Emerging Market Preview: Week Ahead

The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings. We do not think individual country stories will matter much in this new investment climate, where risk assets are likely to remain under broad-based...

Read More »FX Weekly Preview: Post-Brexit: Week One

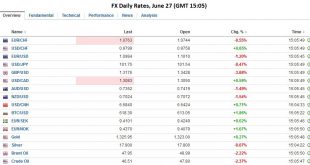

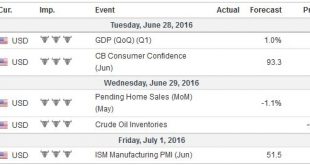

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week. The UK choice to leave the EU on a 52%-48% vote is one of those moments that define before and after. It is true that there are examples of the EU not liking the outcome of a referendum and allowed a...

Read More »Cool Video: Early Thoughts on Brexit Implications with FT’s John Authers

Click to see the video. About a dozen hours after it became clear that a slight majority of the British voters favored leaving the UK, the Financial Times’ John Authers visited me at Brown Brothers Harriman to discuss the initial implications. The situation is very fluid and there are many moving pieces. In Chinese, the characters for crisis are “danger” and “opportunity.” The danger component is the first cut...

Read More »El-Erian: Cash is more valuable than ever

Mohamed El-Erian says the global economy is at a crossroads. ‘Investors cannot rely on correlations as a risk mitigator,’ he says Investors shouldn’t underestimate the role of cash in their portfolios said Mohamed El-Erian, chief economic adviser at Allianz Global Investors. At a breakfast meeting with reporters on Monday, the former Pacific Investment Management Company chief executive said central bank asset...

Read More »Weekly Speculative Positions: Speculators Cut Currency Exposure ahead of FOMC, BOJ, and Brexit

On the Swiss Franc: The data shows that the Net positioning in the Swiss Franc barely changed, as of June 21, when compared to the previous week. The CFTC reporting week ending June 21 covers the day FOMC and BOJ meetings and ends two days before the UK referendum. The overarching theme was the reduction of exposure. This is not measured by net positions but by gross positions. Of the eight currencies we track,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org