The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of .40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost .4845, its highest level since last December. The market continues to put anticipate the UK stays in the EU and has bid sterling to new highs for the year. More broadly, the dollar and yen are heavy against the major and emerging market currencies. Equities are rallying. It is the fifth consecutive advance of the MSCI Emerging Market equity index. The MSCI Asia-Pacific Index was up 0.75%, while the Dow Jones Stoxx 600 is 1.4% higher, led by telecoms and material sectors. Core bond yields are 2-5 bp higher, while peripheral bonds yields are 4-6 bp lower, though Greek bonds, which the ECB will begin accepting again as collateral, are seeing an 11 bp decline in 10-year yields. The high beta emerging market currencies, like the Russian ruble, the South African rand, and Mexican peso are leading the EM, followed by Eastern and Central European currencies.

Topics:

Marc Chandler considers the following as important: Brexit, Featured, FX Daily, FX Trends, GBP, JPY, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December.

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December.

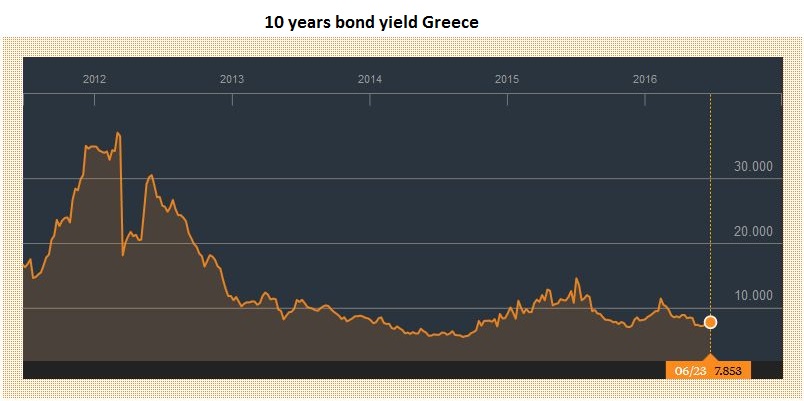

The market continues to put anticipate the UK stays in the EU and has bid sterling to new highs for the year. More broadly, the dollar and yen are heavy against the major and emerging market currencies. Equities are rallying. It is the fifth consecutive advance of the MSCI Emerging Market equity index. The MSCI Asia-Pacific Index was up 0.75%, while the Dow Jones Stoxx 600 is 1.4% higher, led by telecoms and material sectors. Core bond yields are 2-5 bp higher, while peripheral bonds yields are 4-6 bp lower, though Greek bonds, which the ECB will begin accepting again as collateral, are seeing an 11 bp decline in 10-year yields. The high beta emerging market currencies, like the Russian ruble, the South African rand, and Mexican peso are leading the EM, followed by Eastern and Central European currencies.

Sterling has consolidated its latest gains, and also the momentum has stalled, it remains in the upper end of the ranges seen over the past two sessions. The US dollar is broadly lower against all the major currencies save the Japanese yen. The dollar traded on both sides of yesterday’s range against the yen. It has been unable to make much headway above JPY105. It appears to be carving out a little base around JPY104. There has been some indication that the BOJ may have been holding back on its rinban and QQE operations in the JGB market as if to prepare a bigger war chest in case of a Brexit vote.

There are a couple of points to make about the UK referendum. First, the betting and event markets have moved well ahead of the polls. Nearly all the last phone polls show remain ahead, while most of the online surveys show leave ahead. We note that speculator in the futures markets had been adding to gross long sterling positions in the week before the market actually turned.

Under such circumstances, the market seems vulnerable to a “buy the rumor sell the fact” type of activity. The fast participants, speculators, hedge funds may take profits as the slower participants, like corporations, asset managers and the like more gradually re-build the UK exposure that had been shed.

Second, that said, it may be helpful to consider some potential chart points as mile markers of sorts. The $1.4885 area corresponds to a 50% retracement of the down move since last June’s high around $1.5930. The upper Bollinger Band that has been frayed a bit comes in near $1.4835. Above there is the 61.8% retracement near $1.5130, and the 100-day moving average is near $1.5230. Sterling has shot up so quickly; it is difficult to have much confidence in nearby support, though a break of $1.46 would signal the snapping of the momentum.

Third, the polls close at 10 pm BST, which is 5 pm EST. The first results expected to take roughly two hours to begin trickling in. Of course, all districts are not equal. Areas, for example, in which UKIP has run strong in recent elections, should be expected to vote for the exit, while the most cosmopolitan cities and university areas can be expected to favor remain. The demographic that favors Brexit appear to be lower incomes, no college degree, and older voters. A record 46.5 mln citizens have registered to vote.

Fourth, liquidity is expected to be compromised. The results will be reported during the Asian session, which is typically not the most active. While traders around the world will be watching events unfold, there is a great risk, and that will be impacting market conditions. As has been the case, but especially now, after the strong move over the past week, a vote to leave the EU will have a much greater impact than a decision to stay. Turnout is key, and incidentally, the heavy rain in southeast part of the UK. Including London is experiencing exceptionally poor weather.

Outside of the UK referendum, there are four other developments to note:

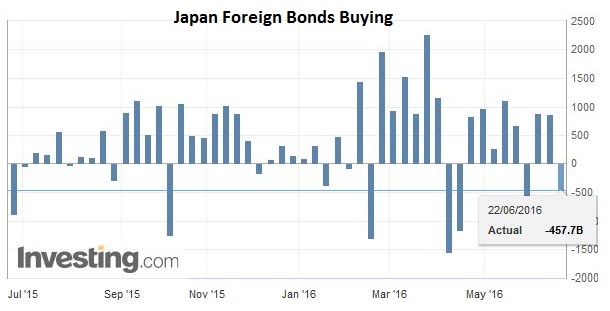

1. JapanFor the first week since the end of March, foreign investors sold Japanese bonds in the week ending June 17, according to the MOF’s weekly data. Over the past 11 weeks, foreign investors bought an average of JPY365 bln of Japanese bonds a week. The selling could be simply normal profit-taking within the large accumulation, which would hypothesize new buying. Alternatively, if part of the buying of negative yielding JGBs was as a proxy for the yen, the liquidation could be an early sign that profit-taking on long yen exposure. |

|

2. ECB and GreeceThere has been a rather subdued reaction to the ECB’s decision to reinstate the waiver for the use of Greek sovereign bonds for collateral. Recall that early last year, as Greece lurched without a program, the ECB stopped accepting Greek bonds as collateral. This forced the Greek banks to rely on more expensive emergency lending by the central bank of Greece. Greek bond yields are lower, but at 7.67%, the 10-year yield, for example, has not made new lows in the week. Nor are Greek equities outperforming. However, the shift back to borrowing from the ECB is a positive development for Greek banks. Financials are leading the Athens Stock Exchange Higher with a 2.3% gain today. Overall, European financials are market performers today, matching the 1.4% gains of the Dow Jones Stoxx 600. |

|

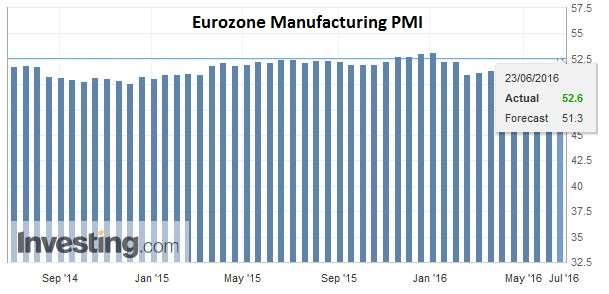

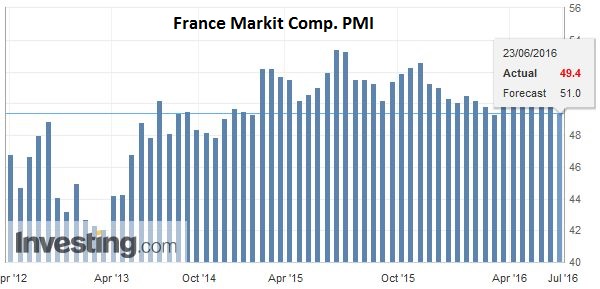

3. EurozoneThe flash June eurozone PMI will not change perceptions that a) the regional economy is slowing after the 0.6% pace in Q1 and b) France is a laggard. The eurozone manufacturing PMI ticked up to 52.6 from 51.5. Many had looked for a small decline. |

|

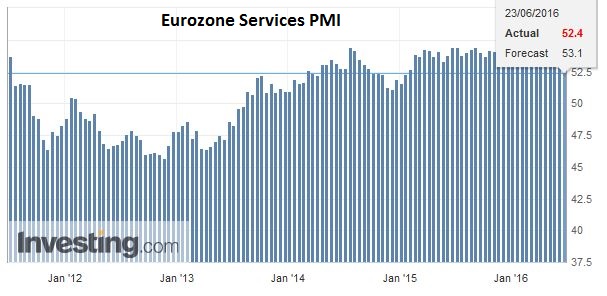

| Services, which, of course, are a larger part of the economy slowed to 52.4 from 53.3, much lower than expected, and the lowest since the end of 2014. The net effect was that the composite reading eased to 52.8 from 53.1. | |

| Of note, the French composite fell back below the 50 boom/bust to 49.4. New manufacturing orders fell for the sixth month. Separately, a measure of business confidence fell to nine-month lows. Lastly, the new TLTROs are launched today, with details tomorrow. The headline draw is likely to be inflated by rolling some outstanding borrowings into the new, more generous facility, and the elevated participation often seen in the first tranche of an operation. | |

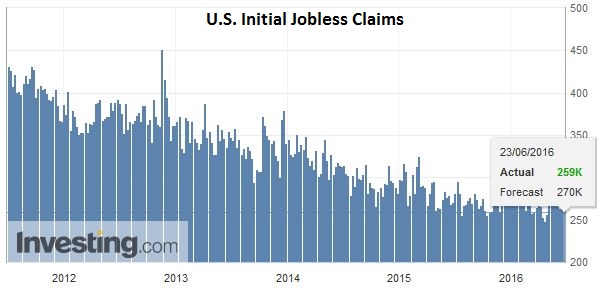

4.United StatesThe UK referendum may keep many investors sidelined today. There are several US economic reports, including weekly initial jobless claims, which have been elevated recently. |

|

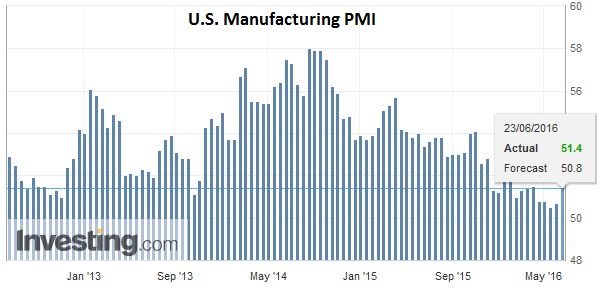

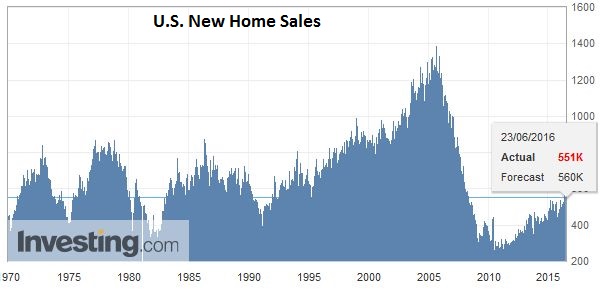

| Markit releases its preliminary manufacturing PMI (expected little higher from 50.7 in May) and new homes sales (sharp pullback is expected after a 16.6% gain in April). | |

| Leading economic indicators (May) and KC Fed’s manufacturing survey typically don’t draw much market interest. |

Graphs and additional information on Swiss Franc by the snbchf team.