The good news is there is a way to avoid failure and stagnation: avoid the mainstream like the plague. The mainstream became mainstream because it worked: the mainstream advice to “go to college and you’ll get a good job” worked, the mainstream financial plan of buying a house to build equity to pass on to your children worked, the mainstream of government regulation worked to the public’s advantage at modest cost to...

Read More »Emerging Markets: What has Changed

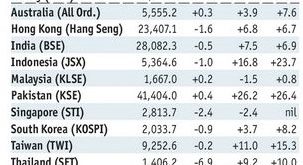

Summary Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program. Chile’s ruling center-left coalition lost municipal elections. Stock Markets In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary...

Read More »Swiss Producer and Import Price Index, September 2016: 0.3% rise in Producer and Import Price Index

Comments by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and...

Read More »The Point of War Is Not to Win

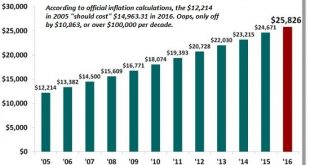

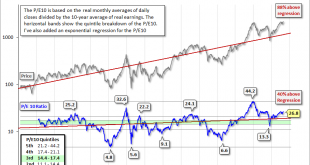

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »FX Daily, October 27: Rising Yields Continue to be the Main Driver

Swiss Franc EUR/CHF - Euro Swiss Franc, October 27(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates have levelled out over the past couple of weeks following some heavy losses earlier this month. The Pound crashed following UK Prime Minister Theresa May’s comments regarding the triggering of Article 50 early next year. Whilst we knew this was coming the timeline was shrouded in uncertainty and the...

Read More »Great Graphic: CRB Index Revisited

Summary: Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods’ prices (think services). Bond yields are rising. The break-even rates, which compare conventional yields to the inflation-linked securities are also rising. These developments, which we do not think can be attributed to central bank...

Read More »Syngenta slumps on concern of protracted ChemChina EU review

© Perolsson | Dreamstime.com Syngenta AG shares tumbled on concern that China National Chemical Corp.’s $43 billion takeover of the Swiss herbicide and pesticide maker risks regulatory delays in the European Union. ChemChina didn’t submit so-called remedies in the EU’s early-stage review of the deal by the Oct. 21 deadline, the European Commission’s press office said by phone on Monday. Companies often decide to put off...

Read More »Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

Submitted by Koos Jansen from BullionStar.com After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes? After the Germans had activated a program to...

Read More »Switzerland UBS Consumption Indicator: Confidence despite weakness in retail

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator rose from 1.53 to 1.59 points in September. The positive trend continues and points to further growth in private consumption for the fourth quarter. The driving forces are new...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org