Bern, 03.11.2016 – The latest survey shows that there was hardly any change in consumer sentiment in Switzerland between July and October 2016*. The index currently stands at -13 points and has consistently come in at a value below its long-term average for over a year now. However, consumers believe that the outlook for the economy over the coming months is considerably better than in July. The assessment of price...

Read More »Swiss real estate market UBS Swiss Real Estate Bubble Index 3Q 2016

The UBS Swiss Real Estate Bubble Index stayed in the risk zone in Q3 2016, unchanged at 1.35 index points. The buy-rent price ratio reached an all time high due to a further increase in the price of owner-occupied homes and lower rentals The moderate growth in mortgages and the slightly improved economy however prevented an increase in imbalances on the market for owner-occupied homes. UBS Swiss Real Estate Bubble...

Read More »Der SNB-Milliardengewinn täuscht Stärke vor. Tatsächlich ist die SNB so schwach wie nie.

Voller Stolz präsentiert die SNB ihr Zwischenergebnis für die ersten 9 Monate dieses Jahres: 28.7 Milliarden Franken Gewinn. Und die Medien kolportieren diese Zahlen unbedarft. Die Devisenreserven der SNB seien erneut gestiegen wird da behauptet; und zwar allein in diesen neun Monaten um 73 Milliarden auf sage und schreibe 666 Milliarden Franken. Solche Schlagzeilen sind oberflächlich und lenken von der grossen Gefahr...

Read More »FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

Comment on GBP and CHF by Jonathan Watson My articles My siteAbout meMy booksFollow on:TwitterLinkedIN Swiss Franc The Swiss Franc is a safe haven currency and benefits in time of uncertainty. With Donald Trump now looking much more likely to win the Election the Swissie has found favour. If you are buying the Franc with sterling in the future the combination of global uncertainty and a weak pound looks set...

Read More »Recessions, Predictions and the Stock Market

Only Sell Stocks in Recessions? We were recently made aware of an interview at Bloomberg, in which Tony Dwyer of Cannacord and Brian Wieser of Pivotal Research were quizzed on the recently announced utterly bizarre AT&T – Time Warner merger. We were actually quite surprised that AT&T wanted to buy the giant media turkey. Prior to the offer, TWX still traded 50% below the high it had reached 17 years ago. The...

Read More »EC Pushes Back on (8) Draft Budgets

Long before the UK referendum, many argued that monetary union was undermining the European Union. Many had expected Greece to be forced out not once but twice. There is a cottage industry of books forecasting the demise of EMU. Johan Van Overtveldt, the former Finance Minister of Belgium, penned “End of the Euro” in 2011 and its captures the spirit of the genre. Jen Nordvig, a currency strategist, authored “The Fall...

Read More »Great Graphic: Sentix Shows a Shift

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi’s political reforms. Sentix conducts investor surveys...

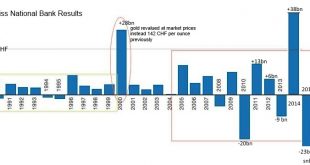

Read More »Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

From the official news release Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. A valuation gain of CHF 7.5 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 20.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are...

Read More »SNB Line in Sand Breaks, EUR/CHF under 1.08

We have always emphasized that the SNB intervenes between 1.08 and 1.0850. Even if there was no change in sight deposits the 1.08 “line in sand” broke. Via ForexLive US election jitters kicked in yesterday as concerns grow on the fall-out and we’ve seen a sharp rise in the franc across the board EURCHF yesterday fell through 1.0800 which has been widely perceived as the SNB unofficial CHF cap but they’ve been...

Read More »FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs EUR/CHF Swiss Franc: The EUR/CHF has fallen again to the SNB intervention levels of 1.08. The dollar has depreciated by more than 1%. Who has followed our blog, knows that the Franc is a proxy for global growth, in particular Emerging Markets. Today’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org