For over a year the federal funds rate has increased relative to the rate the Fed pays on excess reserves. In mid September 2019, the federal funds rate increased abruptly, triggering the Fed to inject fresh funds. In parallel, the repo market rates spiked dramatically. On the Cato Institute’s blog, George Selgin argues that structurally elevated demand collided with reduced supply. He mentions explicit and implicit regulation; Treasury General Account (TGA) balances; the NY Fed’s foreign...

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

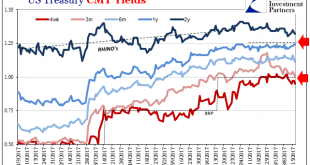

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »Portfolio Adjustments in Money Market Mutual Funds

On the Liberty Street Economics blog, Catherine Chen, Marco Cipriani, Gabriele La Spada, Philip Mulder, and Neha Shah discuss last year’s regulatory changes regarding money market mutual funds: First, institutional prime and muni funds—but not retail or government funds—must now compute their net asset values (NAVs) using market-based factors, thereby abandoning the fixed NAV that had been a hallmark of the MMF industry. Second, all prime and muni funds must adopt a system of gates and...

Read More »Pawn Shops, Information Insensitivity, and Debt-on-Debt

In a BIS working paper (January 2015), Bengt Holmstrom summarizes some of the implications of the research on information insensitive debt. He cautions against moves to increase transparency in debt markets and defends the shadow banking system. He explains why opacity and information insensitivity are valuable and argues that debt-on-debt arrangements are (privately) optimal. It all started with pawn shops: The beauty lies in the fact that collateralised lending obviates the need to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org