With the EU elections fast approaching, this article, written by my dear and long-time friend Natalie Vein, offers a very different perspective. It focuses not on the choices on the ballot, but on the EU voting campaign itself. Most people are fixed on the political show at the front-end of the upcoming election, yet it’s much more enlightening and relevant to look at the actions taken backstage, by the show organizers themselves. The article reveals in no uncertain terms the fact that...

Read More »Sound money: A Biblical perspective – Part I

«It is the mark of an educated mind to be able to entertain an idea without accepting it.»Aristotle In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of...

Read More »Sound money: A Biblical perspective – Part I

«It is the mark of an educated mind to be able to entertain an idea without accepting it.»Aristotle In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:...

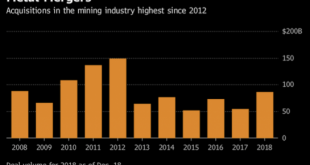

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for...

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion. The deal, that is largely expected to go ahead and be...

Read More »“Today’s EU is the embodiment of bureaucratic hubris”

Interview with Dr. Markus Krall: When it comes to identifying and evaluating the key vulnerabilities and inherent risks of the banking and financial system, there are few who have the insights and practical experience that is required to truly understand the scale of the issue and its investing implications. This is precisely why Claudio Grass turned to Dr. Markus Krall, who graciously agreed to share his thoughts and observations, as well as his outlook on the future of the financial...

Read More »Claudio Grass – Sound Money & Human Liberty Are Inextricably Linked

SBTV speaks with Claudio Grass, an independent precious metals adviser based in Switzerland. A proponent of sound money and the Austrian School of Economics, Claudio shares his convictions on why human liberty and sound money are inextricably linked. Discussed in this interview: 02:39 Relationship between liberty and sound money 06:51 Keynesian view of money 09:58 Similarities between Austrian School and Keynesian economics? 14:00 Geopolitical issues clouding the near future 18:08...

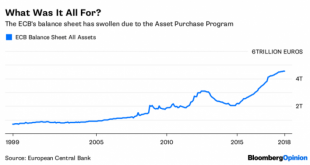

Read More »ECB: running out of runway – Part II

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most...

Read More »ECB: running out of runway – Part II

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most major economies. The encouragement and purposeful incentivization of...

Read More »ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change. As Europe’s economy flashes increasingly bright warning signs, doubts are multiplying over the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org