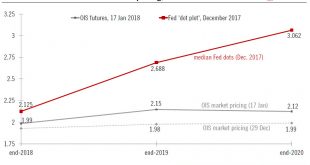

With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation...

Read More »Upside risks to wages from IG Metall negotiations

The outcome of German wage negotiations will have important implications for the broader inflation outlook in the euro area, and thus for ECB policy.German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in...

Read More »House View, January 2018

Pictet Wealth Management's latest positioning across asset classes and invesment themes.Asset AllocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight developed market (DM) equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.Emerging market (EM) equities should continue to perform...

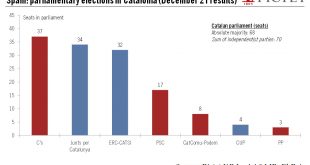

Read More »A crucial start to the year for Catalonia

Spain, like Europe, continues to take political tensions in the region in its stride, but prolonged uncertainty could have an impact on the economy.Following the December regional elections, in which pro-independence parties won a majority of parliamentary seats, the main challenge in Catalonia will be the formation of a new coalition government. Catalan parties have until end March/early April to reach an agreement on the next regional president, failing which repeat elections may need to...

Read More »Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to...

Read More »China: FX reserves rise again

The decline in capital outflows may suggest that investors’ sentiment towards China is improving.According to the Chinese State Administration of Foreign Exchange, China’s FX reserves amounted to USD3.14 trillion at end-December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full-year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015...

Read More »Switzerland: Inflation at a seven-year high

Swiss inflation remained at its highest rate in almost seven years in December. We expect average headline inflation to continue to move higher in 2018.According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% year on year (y-o-y) in December, in line with consensus expectations. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) increased slightly to 0.7% y-o-y in December.In...

Read More »The BoJ is sticking to monetary easing

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing. After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%....

Read More »Global macro: 10 surprises for 2018

Having laid down our expectations for the World economy in 2018, in this note we describe a number of potential surprises to the outlook. The usual suspects, or ‘known unknowns’, include a larger-than-expected fiscal boost from US tax cuts, (geo-)political risks, economic policy mistakes, inflation surprises, a financial bubble burst, or a Minsky moment in China, to name a few. We chose to include some of the...

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org