Nudged by the White House, Congress is in fiscal easing mode in the belief that the US economy needs further stimulus. Meanwhile, some medium-term debt issues remain unaddressed.Washington DC is in fiscal easing mode. Having voted for bold tax cuts in December, Congress is now increasing the theoretical spending limits for this year and next, by USD 300bn. This comes even though budget data for the past two years have been disappointing notwithstanding a solid labour market.From a growth perspective, we think rising federal government spending poses slight upside risks for GDP growth, particularly in 2019 (our current forecast for 2019 is 2.4% GDP growth, 0.1ppt above current consensus). Spending bills in March, showing the amounts the government effectively plans to spend, will enable us

Topics:

Thomas Costerg considers the following as important: Macroview, US budget deficit, US debt metrics, US debt projections, US fiscal stimulus

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Nudged by the White House, Congress is in fiscal easing mode in the belief that the US economy needs further stimulus. Meanwhile, some medium-term debt issues remain unaddressed.

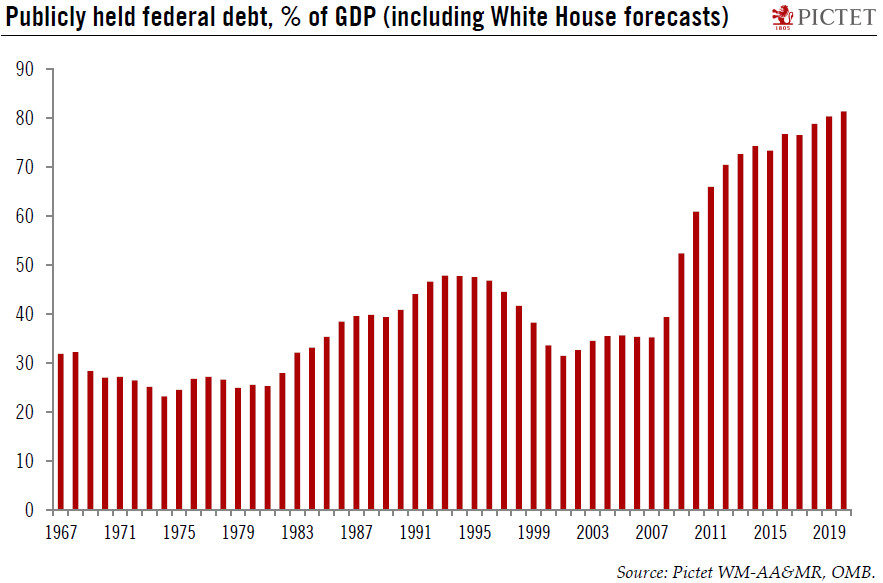

Washington DC is in fiscal easing mode. Having voted for bold tax cuts in December, Congress is now increasing the theoretical spending limits for this year and next, by USD 300bn. This comes even though budget data for the past two years have been disappointing notwithstanding a solid labour market.

From a growth perspective, we think rising federal government spending poses slight upside risks for GDP growth, particularly in 2019 (our current forecast for 2019 is 2.4% GDP growth, 0.1ppt above current consensus). Spending bills in March, showing the amounts the government effectively plans to spend, will enable us to fine-tune our forecasts.

This fiscal loosening comes at a time of accelerating global and US growth, which has led the Fed to adopt a more hawkish stance in recent weeks. While the Fed had been planning three rate hikes this year, it is likely to bump that forecast up to four at its March meeting. We ourselves continue to expect four rate hikes this year and two in 2019. But we still do not think the Fed, now led by Jerome Powell, will over-do the tightening.

The key medium-term issue is entitlement spending, which remains crucially unreformed. In the near term, a positive for the US debt profile is the likely sharp pick-up in GDP growth this year, giving the benefit of the doubt to the Republican leadership’s belief that fiscal easing will have a ‘J-curve’ effect on tax revenues. But with President Trump and the Republican leadership in no hurry to address entitlement spending either, something will eventually have to give – if not, taxes could soon be on the rise again, or new taxes could appear in the coming years, like the much-resisted federal value-added tax.