The government is ramping up spending and tax cuts to households to relieve pressure on the economy. Corporates may also benefit from fiscal measures.As the economy continues to decelerate, the Chinese government is ramping up fiscal policy, in order to offset downward pressure. Since June, the government’s fiscal spending has picked up significantly, although it remains fairly modest compared with previous years.In the first five months of the year, China’s fiscal policy was on the tight side, with government spending failing to keep pace with the rapid increase in tax revenues. However, fiscal spending has picked up since June, with the cumulative fiscal deficit at end-September the same as the same date last year.China’s fiscal spending remains somewhat modest, however, reflecting, we

Topics:

Dong Chen considers the following as important: china fiscal stimulus, China growth, China trade war, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The government is ramping up spending and tax cuts to households to relieve pressure on the economy. Corporates may also benefit from fiscal measures.

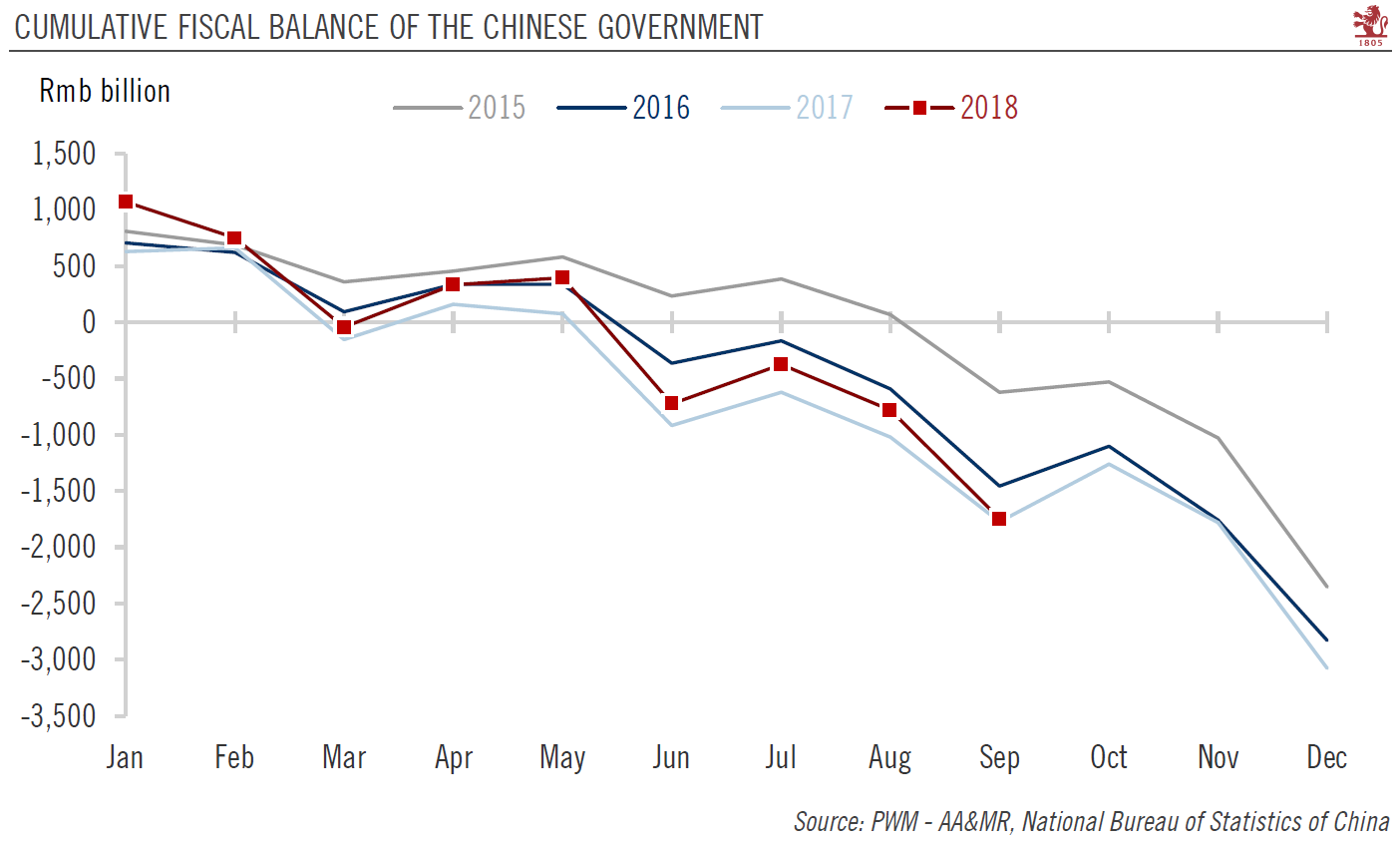

As the economy continues to decelerate, the Chinese government is ramping up fiscal policy, in order to offset downward pressure. Since June, the government’s fiscal spending has picked up significantly, although it remains fairly modest compared with previous years.

In the first five months of the year, China’s fiscal policy was on the tight side, with government spending failing to keep pace with the rapid increase in tax revenues. However, fiscal spending has picked up since June, with the cumulative fiscal deficit at end-September the same as the same date last year.

China’s fiscal spending remains somewhat modest, however, reflecting, we believe, a preference for “quality growth” over “quantity growth”. After years of heavily investing in highways, high-speed rail, airports and power plants, the authorities now appear to be moving away from infrastructure projects that make little social or economic sense. Given the ongoing deleveraging campaign, it is hard to envision another wave of massive infrastructure investment anytime soon.

The government is also resorting to supply-side tools such as tax cuts to stimulate the economy. It has already lifted the tax-free income threshold from RMB3,500 per month to RMB5,000 (effective since 1 October 2018), More recently, the Chinese government announced further plans to cut the personal income tax burden from 1 January 2019. In the latest proposal, six additional tax-deductible items are to be introduced, covering expenses on education, medical payments, mortgage interest, housing rents and support for the elderly. The potential increase in household disposable income due to the tax reforms announced so far could boost household consumption by 0.9% in 2019 and nominal GDP growth by 0.3%.

Looking forward, we expect tax cuts to be extended to the corporate sector as well, in particular value-added tax (VAT) and corporate income tax. These measures, in conjunction with increasing fiscal spending, could help mitigate the downside risks facing the Chinese economy in the wake of its escalating trade tensions with the US.