The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they already want to anyway. As Powell signals to portfolio managers managing the S&P on its upward trajectory, Economists believe stocks are then a signal to consumers and businesses. Flying share prices, they think the public thinks, are the definitive indication for how the economy must be progressing. So,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bank reserves, currencies, Deflation, economy, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, jay powell, Markets, newsletter, QE, S&P 500, S&P 500, stock bubble, stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

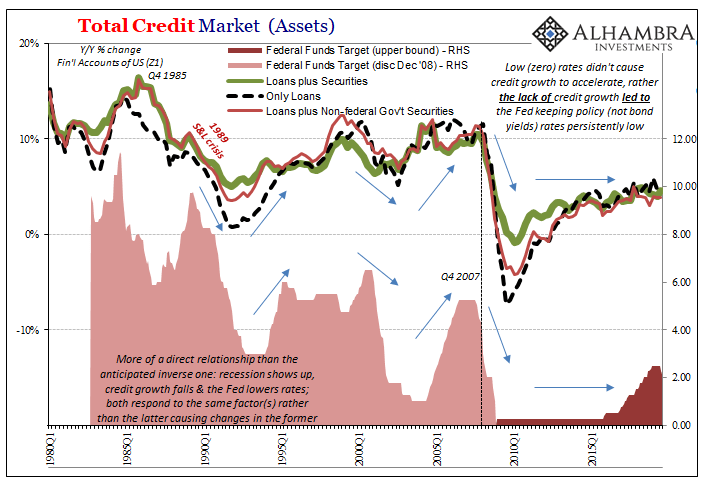

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they already want to anyway.

As Powell signals to portfolio managers managing the S&P on its upward trajectory, Economists believe stocks are then a signal to consumers and businesses.

Flying share prices, they think the public thinks, are the definitive indication for how the economy must be progressing.

So, if you are the Federal Reserve Chairman and you’ve just been handed the mainstream modeled projections for the next few years, you break with all tradition and outright embrace the damn stock bubble. The higher the better, baby!

Why? The alternative is allowing the public in on the secret; that this is going to be more painful than 2008 and 2009 ever was. Should the people get wise to this likelihood, Economists and policymakers (I repeat myself) really believe you and I will make it even worse. So bad, “stimulus” won’t be able to save any jobs.

Better to have share prices climb to infinity and hope to restart some consumer spending lest the big “D” show up in their place. More than it already has, I mean.

If you want to know exactly why Powell seems to have lost his mind, openly courting all the bad things people associate with the Fed, today’s CPI is just the ticket.

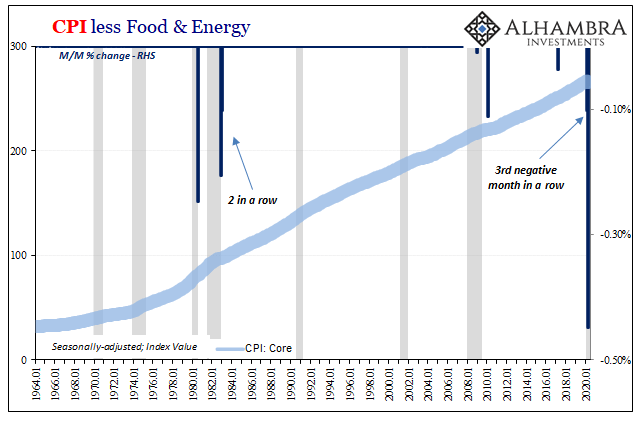

The Bureau of Labor Statistics (BLS) has price data going back a very long way, all the way to 1913. The price history for the “core” CPI, the consumer bucket stripped of energy and food prices, doesn’t go back quite that far but it does stretch as far back as 1957. Sixty-three years is a lot of data.

|

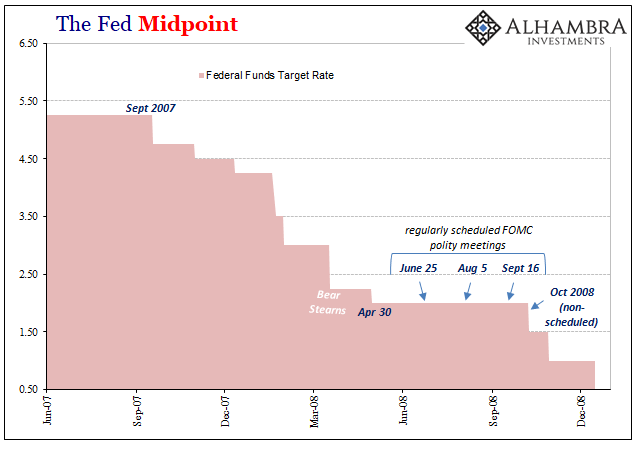

Since the core rate is meant to illuminate the vast majority of prices that aren’t being influenced largely by oil (therefore the volatile changes to what consumers pay at the pump for gasoline), this central consumer price series doesn’t move around all that much – by design. As noted last month, it rarely ever declines on a monthly, seasonally-adjusted basis. Before 2020, only once had it fallen for two consecutive months and that was November and December 1982. Say what you want about consumer price indices like these, and there’s a lot to dislike about them, you can’t deny the correlations. These rare core CPI drops correspond with only the worst kinds of economic conditions. What the BLS reported last month for April 2020 was already the worst monthly change in the entire series. Since that followed a negative the month before in March, albeit a smaller one, already Jay Powell must’ve been put on edge by the troubling implications of matching 1981-82 right out of the gate. Along with continuously subdued inflation expectations trading throughout TIPS despite all the “money printing”, the CPI data almost certainly motivated the guy to lie his ass off on 60 Minutes. He knows he’s in danger of falling behind the wave, if he hadn’t already (by that whole GFC2 thing he apparently saw coming but didn’t prepare for ahead of time). |

CPI less Food & Energy, 1964-2020 |

| Today, the BLS reports even more disturbing results. For the first time in its long history, the core CPI in May fell month-over-month yet again, making now three in a row.

It isn’t quite yet the big “D” but we’re definitely moving in that direction. Thus, the official embrace of anything and everything – even a stock bubble – that might go the other way. This isn’t about commodities and the oil price crash. And food prices right now are through the roof (supply shock). No, this is forcing all of us to be more precise about the term “deflation.”

|

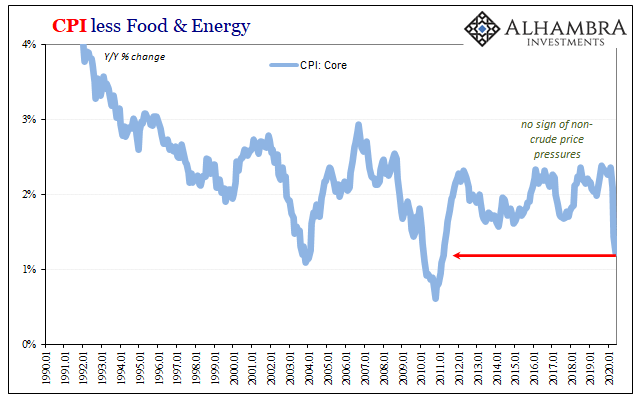

CPI less Food & Energy, 1990-2020 |

| I’m as guilty as anyone, if not more so, of using the term a little too loosely to fit our current age. Commodity price deflation as a result of Euro$ #3, for example, doesn’t really go far enough.

But it could if the resulting economic contraction and scramble for dollars leaves such overcapacity and desperation for liquidity in the business and financial sectors. Once that happens, past some unknowable threshold, true deflation takes hold and it can only end up in the labor market (as Keynes recognized). Overproduction, they used to call it. Too much spare inventory and capacity because of a demand shortfall so large companies have to first discount goods – and services – before being left to liquidate at any price. |

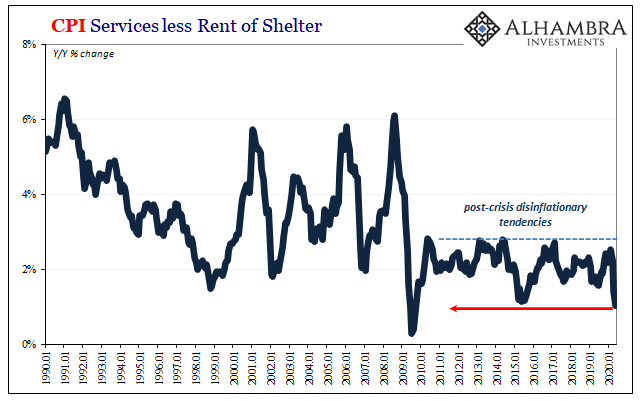

CPI Services less Rent of Shelter, 1990-2020 |

| This was the dirty little process which put the “great” in the Great Depression.

The CPI figures don’t put us that far along, not just yet, but they are most definitely on that same spectrum. And that is why Jay Powell and the FOMC (like the ECB) are in total panic mode. They will accept and encourage anything and everything even remotely attached to the idea of inflation to try and obtain what they believe is necessary to avoid the opposite fate. |

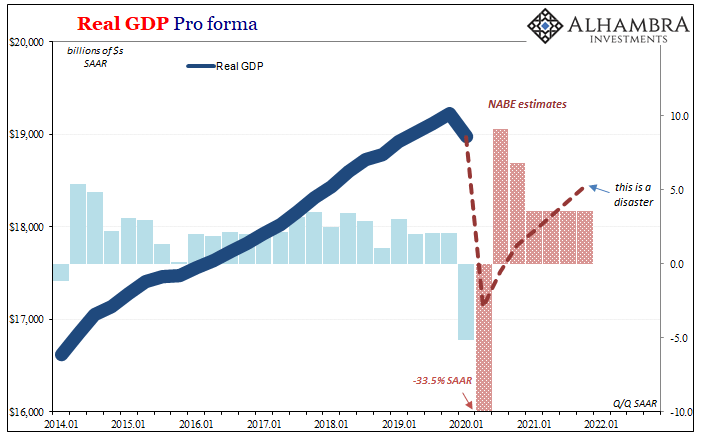

Real GDP Pro Forma, 2014-2022 |

| Inflationary in any form they can get they’ll now take no matter how ridiculous it might sound to pre-GFC2 ears.

The real problem, of course, is that inflation actually isn’t the opposite of deflation. Both are basically two sides of the same coin, a lesson they all should’ve taken from so much study of the Great Depression. You don’t beat deflation with dreams of inflation; nor would you with actual inflation, assuming the Fed had the power to create it. Deflation like inflation is a symptom of monetary instability, grave instability which threatens the most fundamental aspects of the economy (labor most directly). No, the answer to deflation isn’t inflation; it’s stability, the opposite of instability. |

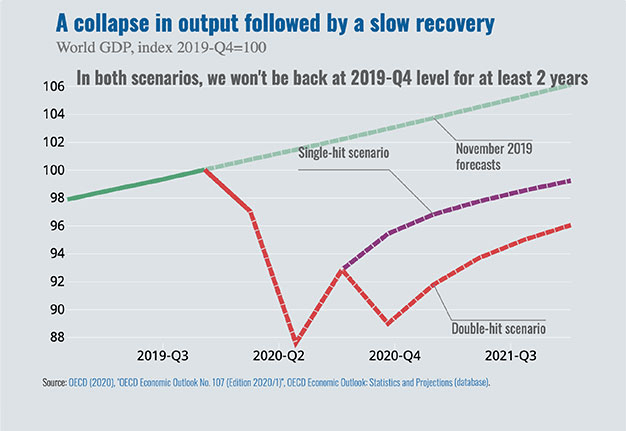

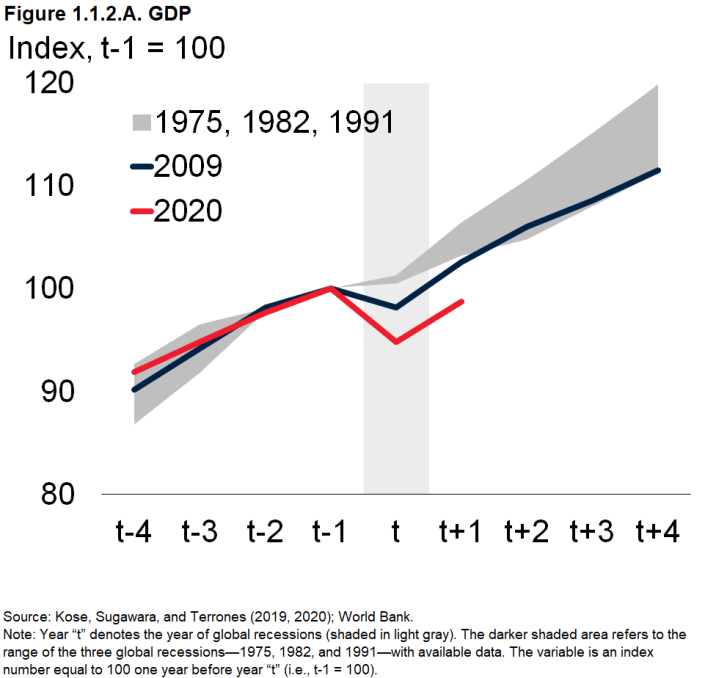

A collapse in output followed by a slow recovery, Q3 2019- Q3 2021 |

Mainstream Models World Bank |

|

| Even powerless to create some, as the data keeps showing, Powell’s puppet show can be harmful nonetheless (more instability). Just look at the S&P 500 and compare it to all those optimistic mainstream “V”s (above) that are alarmingly, uniformly light on their right. By embracing the anything-goes approach, he’s setting everyone up for a bigger fall even if their optimistic scenario pans out (being optimistic about a disaster is still a disaster).

The one that’s more and more confirmed as not “money printing” and not “stimulus” deep inside the real economy. The core CPI just fell for the third month in a row, the first time that’s ever happened. But more QE. |

. |

Tags: bank reserves,currencies,Deflation,economy,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,jay powell,Markets,newsletter,QE,S&P 500,stock bubble,stocks