In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven. To keep China going down the same path of rapid growth,...

Read More »Globally Synchronized Asynchronous Growth

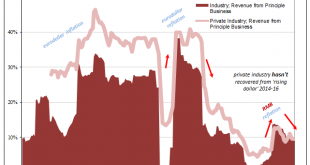

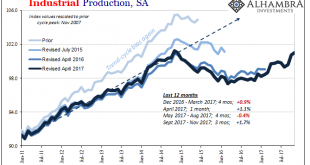

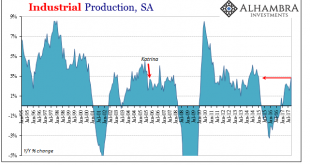

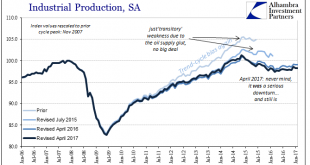

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. US Industrial Production, Jan 2006 - May 2018(see more posts on U.S. Industrial Production, ) - Click to enlarge Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months,...

Read More »The Dismal Boom

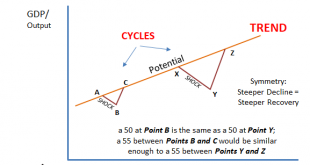

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More »Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

Read More »The Economy Likes Its IP Less Lumpy

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months. Combining April 2017 with October, IP advanced by 2.2% leaving the other 10 to...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

Read More »Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. US Industrial Production, Jan 1995 - Nov 2017(see more posts on U.S. Industrial Production, ) - Click to enlarge That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will...

Read More »Staying Stuck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

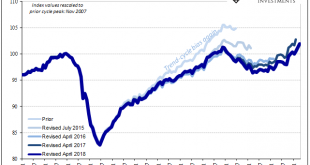

Read More »Hopefully Not Another Three Years

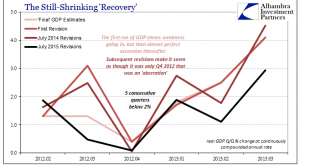

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

Read More »Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org