BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs). This is the second post in the series. Please see...

Read More »“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro’s decision to follow Indian PM Modi’s playbook and announce that the nation’s largest denomination bill (100-Bolivars – worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called “mafias”. As AP reports,...

Read More »Certain Bribe Giving Should Be Treated As Legal

In a 2011 paper, Kaushik Basu argued that “harassment bribes”—bribes that people give to officials in order to get what they are legally entitled to—should be treated as legal. The reasoning is as follows: Under the current law [treated as illegal], … once a bribe is given, the bribe giver and the bribe taker become partners in crime. … Under the new law [treated as illegal], when a person gives a bribe, she will try to keep evidence of the act of bribery so that immediately after the...

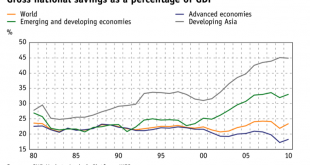

Read More »Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indicator to GDP growth. The Net National Savings Rate (NNSR) is rather positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. The relationship of GDP growth to those four criteria, however, is often a negative correlation. We critized GDP growth that has...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More »Seignorage and Cantillon Effects in India

On Alt-M, Larry White discusses three aspects of the Indian “demonetization” experiment. The transition from old notes blocks “honest” currency transactions, reduces income, and harms the poor who don’t have access to alternative means of payment. Because not all old notes will be redeemed, the transition into new notes will generate seignorage revenue for the government on the order of USD 40 billion, according to White’s estimates. Not all groups or industries get access to the new...

Read More »Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

Submitted by Koos Jansen from BullionStar.com Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled...

Read More »Gold Price Skyrockets in India after Currency Ban – Part III

When Money Dies In part-I of the dispatch we talked about what happened during the first two days after Indian Prime Minister, Narendra Modi banned Rs 500 and Rs 1000 banknotes, comprising of 88% of the monetary value of cash in circulation. In part-II, we talked about the scenes, chaos, desperation, and massive loss of productive capacity that this ban had led to over the next few days. Indian prime minister...

Read More »Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org