Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…) Anyways, it’s normal to grow out of this naïve view of television. No one believes it past the age of eight, much less into adulthood. Purchasing Power and Intrinsicism This is a simple...

Read More »How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”. Or it makes all employers obtain government permission for a long and growing list of things, and then denies permission arbitrarily and...

Read More »What Trick did Tricky Dicky Pull 50 Years Ago Today?

Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one. On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments. This bad decision is the latter, a desperate attempt to avoid the consequences of previous bad decisions. Tricky Dicky’s Catastrophe Richard “Tricky Dicky” Nixon...

Read More »Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate. The M0 measure has nearly doubled since the start of Covid. It is also a fact that many prices have jumped up significantly. So only one question is open for debate. Is...

Read More »Resetting the Federal Debt

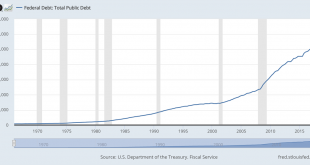

According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more. Keep in mind, this is only that part of the total liabilities that the government chooses to acknowledge. If it reported its financials the way all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org