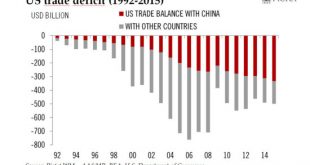

There is a high risk that tensions between the US and China over the latter’s rise are set to come to a head under Trump’s presidency and become an important source of market volatility.The relationship between the US and China is of vital importance for the world both from an economic and a geopolitical perspective. Competition between the two powers could be set to come to a head under Donald Trump’s presidency. First, the trade relationship with China is a central issue in the Trump...

Read More »The crisis in the Middle East and oil prices

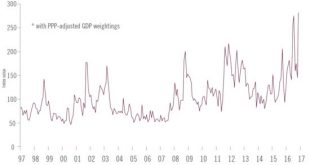

We expect oil prices broadly to stabilise in 2017—but prices will continue to be affected by geopolitical shocks in the region, which will also create tremors on financial markets.Oil currently seems to have reached its fair value at around USD50 per barrel for Brent crude. We expect prices to average around USD55/b in 2017, while supply continues to adapt to sluggish demand. The agreement between OPEC members on 30 November and with non-OPEC producers a week later should reinforce the trend...

Read More »Geopolitics and investing: assessing rising instability

With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international...

Read More »Toward a New World Order, Part II

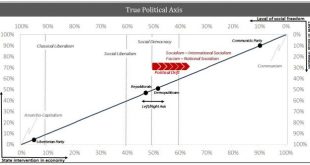

True Political Axis One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil. Which party representing good and...

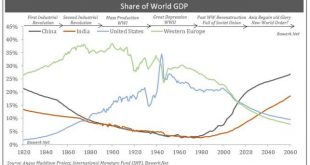

Read More »Toward a New World Order?

Share of World GDP A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future. As an experiment, assume, as most long term forecasters do,...

Read More »The Road to Fascism in Just Two Charts

[unable to retrieve full-text content]Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »The Dos Santos Succession Saga

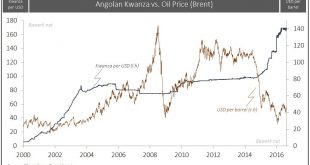

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More »Is Globalization Finished?

The shock of Great Britain’s vote to leave the European Union has already thrown global financial markets into disarray and cost Prime Minister David Cameron his job, but it will take years before the geopolitical impact of the Brexit referendum fully materializes. The political uncertainty generated by the “Leave” vote will reach far beyond 10 Downing Street, potentially into Scotland, Northern Ireland, Eurozone capitals, and beyond. It may even mark the beginning of the end of...

Read More »South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters. To be clear, our long term geostrategic position remains unchanged; China moving towards the ‘nine dash’ line China will gradually secure control of...

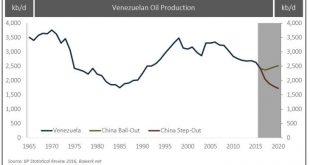

Read More »China the lender of last resort for many oil producers

Summary: Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs. It took a while to play through, but our assessment that China would increasingly become the petro-state lender of last resort is starting to come good. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org