Sterling’s 2.75% rally today is the biggest advance in more than eight years. The UK government has done a good job of managing expectations. Over the last week or so, Prime Minister May and Chancellor of the Exchequer Hammond has made it clear that the intention was a “clean break” from the EU. There is an implicit threat by both officials not to see a punitive agreement. There was, though little new in May’s speech...

Read More »FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

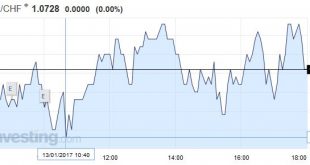

Swiss Franc EUR/CHF - Euro Swiss Franc, January 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate rose today as investors were pleased by Theresa May’s comments about the Brexit. We are looking now at a more decisive Prime Minister Theresa May who has set out a plan and some objectives which if realised will create a much stronger and better Brexit than political...

Read More »FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

Swiss Franc EUR/CHF - Euro Swiss Franc, January 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF - British Pound Swiss Franc, January 17(see more posts on GBP/CHF, ) - Click to enlarge FX Rates The US dollar is broadly lower against major and emerging market currencies. It has given up yesterday’s gains and more. The proximate cause appears to be comments by President-elect Trump in a Wall...

Read More »FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

Swiss Franc EUR/CHF - Euro Swiss Franc, January 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO...

Read More »Weekly Speculative Positions: CHF and GBP net shorts are slowly rising again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Position: CHF Net Shorts rising, but JPY net shorts falling

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Summary: Bank of Canada may be more upbeat following strong jobs and trade figures. China’s President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May’s speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push...

Read More »FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

Swiss Franc Currency Index For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days. Trade-weighted index Swiss Franc, January 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More »The Difference of an A and BBB for Italy

Summary: DBRS cut Italy’s rating to BBB from A. It will increase the haircut on Italy’s sovereign bonds used for collateral by Italian banks. It is not a mortal blow or a significant hit, but is not helpful, except to add pressure on Italy and further reduce its ability to respond to another shock. The ECB takes the best credit rating of four agencies to set the haircut on collateral provided by banks for loans....

Read More »FX Daily, January 13: Corrective Forces Persist

Swiss Franc EUR/CHF - Euro Swiss Franc, January 13(see more posts on EUR/CHF, ) - Click to enlarge Supreme Court Judgement expected imminently The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org