Swiss Franc EUR/CHF - Euro Swiss Franc, January 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate rose today as investors were pleased by Theresa May’s comments about the Brexit. We are looking now at a more decisive Prime Minister Theresa May who has set out a plan and some objectives which if realised will create a much stronger and better Brexit than political commentators give credit for. GBPCHF could continue to rise and clients looking to sell CHF for pounds should be keeping a close eye on the rate but might wish to move a little sooner to avoid disappointment. The volatility on the pound should continue this week as we continue to await the Supreme Court decision and further news on the UK economy. The Franc is generally supported by its status as a safe haven currency which means in times of economic and global uncertainty it will strengthen. The Brexit vote and Trump’s election are seen as global risk events which will see the market fall further if the Swiss Franc maintains this status. Even if the Swiss Franc does weaken a little it will still remain very popular and I cannot see any major devaluing of the Swissie. The pound should therefore be the main driver on GBPCHF rates as this is the main focus for the markets.

Topics:

Marc Chandler considers the following as important: EUR, Eurozone ZEW Economic Sentiment, FX Trends, GBP, Germany ZEW Economic Sentiment, JPY, newslettersent, SPY, U.K. Consumer Price Index, USD, Yuan

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 17(see more posts on EUR/CHF, ) |

GBP/CHFThe pound to Swiss Franc exchange rate rose today as investors were pleased by Theresa May’s comments about the Brexit. We are looking now at a more decisive Prime Minister Theresa May who has set out a plan and some objectives which if realised will create a much stronger and better Brexit than political commentators give credit for. GBPCHF could continue to rise and clients looking to sell CHF for pounds should be keeping a close eye on the rate but might wish to move a little sooner to avoid disappointment. The volatility on the pound should continue this week as we continue to await the Supreme Court decision and further news on the UK economy. The Franc is generally supported by its status as a safe haven currency which means in times of economic and global uncertainty it will strengthen. The Brexit vote and Trump’s election are seen as global risk events which will see the market fall further if the Swiss Franc maintains this status. Even if the Swiss Franc does weaken a little it will still remain very popular and I cannot see any major devaluing of the Swissie. The pound should therefore be the main driver on GBPCHF rates as this is the main focus for the markets. I would expect GBPCHF will remain supported but the rest of the week could have plenty of surprises. Namely the inauguration of Donald Trump is a risk event which could send the Franc stronger. |

GBP/CHF - British Pound Swiss Franc, January 17(see more posts on GBP/CHF, ) |

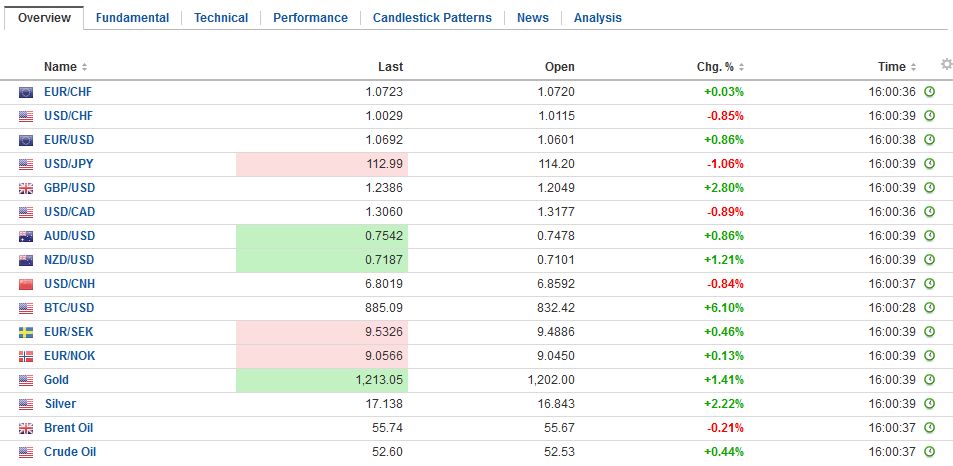

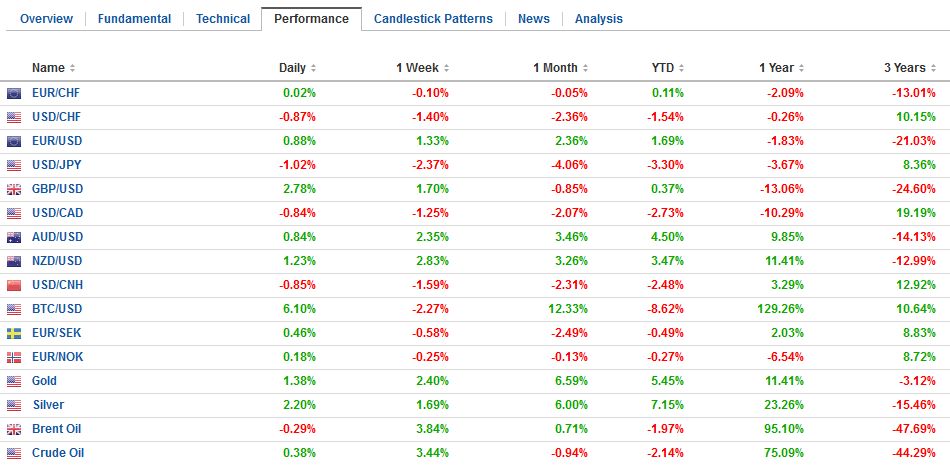

FX RatesThe US dollar is broadly lower against major and emerging market currencies. It has given up yesterday’s gains and more. The proximate cause appears to be comments by President-elect Trump in a Wall Street Journal interview. The dollar’s recent losses against the yen are being extended today. The greenback fell to almost JPY113.00, its lowest level since December 5. In addition to the broad dollar decline today, other drivers seem to be also encouraging short-covering of previously sold yen positions. US 10-year yields are six basis points lower at 2.33%. The low point last week was almost 2.30%. Recall that the yield peaked near 2.64% in the middle of December. Also, US equities are trading lower, with the S&P are called to open around 0.5% lower. The Nikkei itself gapped lower (gap:19043-19061) and closed off 1.5%, for its biggest loss since the US election. It closed on its lows, which has not been seen since December 8. |

FX Daily Rates, January 17 |

| The dollar lost 0.6% against the Chinese yuan. At a little below CNY6.86, the dollar is at its weakest against the yuan since mid-November. While this likely reflects the broadly weaker dollar, China’s overnight repo rate jumped 23 bp to 2.40%. This does not seem to be tied to the short squeeze officials engineered early this month in the offshore yuan. Instead, the onshore pressure comes from the tightening of conditions ahead of the Lunar New Year holidays. The PBOC has tried to offset the shortage by injecting a relatively large amount (net CNY270 bln or ~$39 bln) the most since last January. The Lunar New Year holiday runs from January 27 through February 2. |

FX Performance, January 17 |

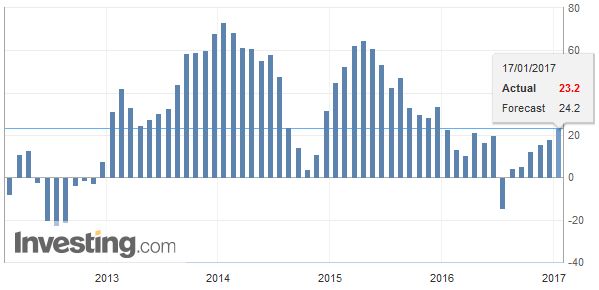

United KingdomThe highlight of today was supposed to be UK Prime Minister May’s speech on Brexit. Much of what she is going to say is believed to have been largely reported with advanced extracts. The essence of the approach is a “clean break” with the EU, including the single market. Also, we expected the time frame for triggering Article 50 remains the same, end of Q1. That said, recall the Supreme Court ruling on the role of Parliament and the snafu in Northern Ireland pose risks to the plans. Sterling gapped lower yesterday in Asia, falling below $1.20 briefly after Chancellor of the Exchequer Hammond appeared to threaten sharp cuts in UK corporate tax rates if necessary to remain competitive in post-EU circumstances. It filled the gap today, which extended a little above $1.2120. Sterling approached $1.2190, with the help of a firmer CPI (1.6% up from 1.2% in November, and the highest since July 2014, with the core rate also firming. A break now of $.12080 would suggest the short-squeeze may have run its course. |

U.K. Consumer Price Index (CPI) YoY, December 2016(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

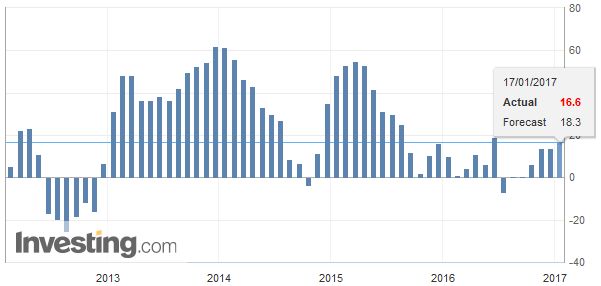

EurozoneThe ECB meeting in a couple of days is another highlight of the week. The euro slipped to $1.0580 yesterday and rallied a cent by early European hours today. It stopped just shy of last week’s high set on January 12 at $1.0685. Intraday technicals, like for sterling, suggest the North American dealers may be more constructive on the dollar as it was several days last week. Initial support for the euro is seen near $1.0620-$1.6030. |

Eurozone ZEW Economic Sentiment, December 2016(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

GermanyThe German ZEW had a little perceptible impact. The January reading saw improvement, more in the assessment of the current situation (77.3 from 63.5 and 65.0 median guesstimates in the Bloomberg survey) than in expectations (16.6 from 13.8 and 18.4 median). The final estimate of Germany’s December CPI will be released tomorrow. It is expected to confirm the 1.7% preliminary estimate, and is a timely reminder ahead of the ECB meeting of the challenges of a one-zone fits all monetary policy. |

Germany ZEW Economic Sentiment, December 2016(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

There are two parts of Trump’s comments that would have likely weighed on the dollar separately, and together they seem to be worth between 0.5% and 1.0% for the major currencies. First, Trump pushed against the “border adjustment” plan from Republicans that would have taxed imports and exempted exports. He said it was “too complicated.” Recall, many economics, including Harvard’s Martin Feldstein, argued that the tax would spur an “automatic” 20-25% increase in the dollar.

Second, Trump specifically said the dollar was too strong. The context was about China, but the remarks seemed to have broader implications. “Our companies can’t compete with them [China] now because our currency is too strong. And it is killing us.” He said the yuan was “dropping like a rock” and the central bank was supported it simply “because they don’t want us to get angry.”

The investment community, like Americans themselves, is grappling with how literal to take the seemingly visceral remarks. Some of the strident positions taken during the campaign have been softened, including the nomination of at least five men from Goldman Sachs, not pushing for criminal charges against Clinton, and citing China as a currency market manipulator on Day 1 (which, in any event, is now said to be not the day after inauguration but Monday January 23). It is the uncertainty that is weighing on the greenback today.

In the larger picture, of the numerous factors that impact foreign exchange rates, the wish and desires of officials do not often seem to be particularly salient. Our long-term bullish outlook for the dollar is based on the divergence of monetary policy, the relative health of the financial system, the anticipated policy mix, and the uncertainty surrounding this year’s elections in Europe.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Eurozone ZEW Economic Sentiment,Germany ZEW Economic Sentiment,newslettersent,SPY,U.K. Consumer Price Index,yuan