Summary: Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike. ECB meeting is the most important event of the week. A small change in the risk assessment is likely. The US and Europe have been more disruptive to the global capital markets this year than China. The focus shifts in the week ahead from Yellen’s...

Read More »FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

Swiss Franc vs USD and EUR The Euro remained the strongest among EUR, CHF and USD during the last month. The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%. EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency...

Read More »Great Graphic: Dollar Index Bottoming?

Summary Downside momentum is fading and technicals are showing a bullish divergence. The Dollar Index has not met the minimum corrective retracement target, meaning that it is premature to talk about bear market. We identify two pre-conditions to enter trade. The Dollar Index set the year’s high on January 3 a little above 103.20. Today it made a marginal new lows for the year at 95.464. The previous low, set at...

Read More »FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

Swiss Franc The Euro has fallen by 0.02% to 1.1031 CHF. EUR/CHF - Euro Swiss Franc , July 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week’s gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is...

Read More »Great Graphic: Value vs Growth

This Great Graphic, created on Bloomberg show the performance of growth and value stocks since the start of December 2016. The yellow line is the Russell 1000 Growth Index. The white line is the Russell 1000 Value Index. The outperformance of the former is clear. The Value Index tracks the performance of Russell 1000 companies with lower price-to-book ratios and lower projected growth values. The Growth Index...

Read More »FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

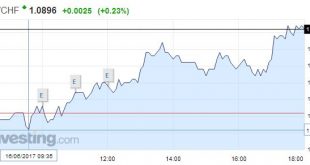

Swiss Franc The euro has appreciated by 0.23% to 1.0896 CHF. EUR/CHF - Euro Swiss Franc(see more posts on EUR/CHF, ) - Click to enlarge FX Rates As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday’s ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of...

Read More »Great Graphic: Sticky Pass Through

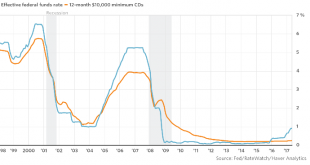

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD. The Fed funds target rate has risen, but the rate of the average yield of the certificate of deposit has not risen. It is at 25 bp, an increase of five basis points over the past four years. Goldstein documents other evidence that...

Read More »FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

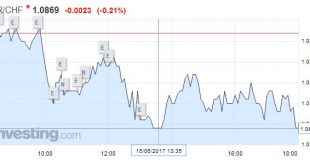

Swiss Franc The Euro has fallen by 0.21% to 1.0869 CHF. EUR/CHF - Euro Swiss Franc, June 15(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month. In some ways, a do-nothing MPC meeting may be overshadowed by the...

Read More »FX Daily, June 14: FOMC and upcoming SNB

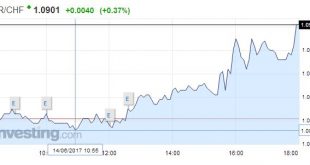

Swiss Franc The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow. This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen. It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates. EUR/CHF - Euro Swiss...

Read More »FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

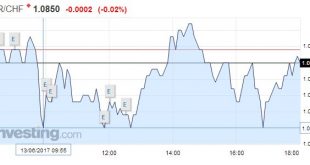

Swiss Franc The Euro has fallen by 0.02% to 1.0850 CHF. EUR/CHF - Euro Swiss Franc, June 13(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org