Summary: Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike. ECB meeting is the most important event of the week. A small change in the risk assessment is likely. The US and Europe have been more disruptive to the global capital markets this year than China. The focus shifts in the week ahead from Yellen’s testimony and disappointing data to the ECB meeting which is expected to result in a further modest adjustment in its risk assessment. While the focus shifts, the pressure on the dollar will likely remain. It fell to new lows for the year last week against the euro, sterling, Swedish krona, and the Canadian

Topics:

Marc Chandler considers the following as important: $CNY, EUR, Featured, FX Trends, GBP, JPY, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike.

ECB meeting is the most important event of the week. A small change in the risk assessment is likely.

The US and Europe have been more disruptive to the global capital markets this year than China.

The focus shifts in the week ahead from Yellen’s testimony and disappointing data to the ECB meeting which is expected to result in a further modest adjustment in its risk assessment. While the focus shifts, the pressure on the dollar will likely remain. It fell to new lows for the year last week against the euro, sterling, Swedish krona, and the Canadian and Australian dollars, among the majors.

Among the actively traded emerging market currencies, the dollar fell to new lows for the year against the central European currencies (forint, zloty, and koruna) as well as the Singapore dollar and Mexican peso. The dollar recorded its lowest close for the year against the Chinese yuan ahead of the weekend.

The markets have doubted the Fed’s commitment to raise interest rates since the start of the year. Perhaps it reflected, in part, the disappointment after the dot plots had suggested four hikes in 2016, only one was delivered. The markets were skeptical of the March hike until officials launched a full court press to convince it otherwise. Officials needed less of a campaign about the June hike. It is a possible third hike this year that the market is now skeptical

On June 15, a day after the last FOMC meeting, the September Fed funds futures contract implied about an 18% chance of a hike, according to the CME. It had fallen a little below 10% before the retail sales and CPI reports before the weekend. There is now almost an 8% chance of a hike priced into the September futures contracts.

The market is skeptical of a December move but less so than after the June hike. A month ago, the market had discounted about a 41% chance of a hike. The pricing implied a 47% chance before the pre-weekend data, which spurred a reassessment that brought the odds down to almost 43%.

As we surmised shortly after the June meeting, a consensus on reducing the balance sheet appears to have emerged before officials seem prepared to hike rates again. Many of officials’ word cues continue to suggest a desire to begin its balance sheet operations soon. Given the perceived need to guide investors understanding, it is preferable to make such an announcement when there is a scheduled press conference. That makes September a likely candidate, and allows officials time to monitor the evolution of price pressures.

Growth forecasts have been trimmed. Currently, the Atlanta Fed’s GDPNow tracker sees 2.4% growth, while the NY Fed’s tracker puts it at 1.9%. Two points ought to be kept in mind. First, such growth rates may seem slow, but those rates are at or slightly above what Fed officials regard as trend growth, which is a pace that is associated with stable prices. The key reason for lower trend cited by Yellen was demographic.

Second, an overall measure of growth (GDP) may not be the end all and be all that the media often makes out, or we may have remembered from Econ 101. Monetary policy is the necessarily the driver of some important parts of GDP, like inventories or the net export function. Policymakers may be interested in the GDP measure that captures final domestic demand.

United StatesThe US economic data in the week ahead does not have the heft to alter investor sentiment. If anything, it may deteriorate further. The healthcare reform bill in the Senate remains stymied by the lack of agreement among the majority party, and the reluctance to try offer measures that would appeal to Democrats, who are prepared to fix rather than repeal and replace the Affordable Care Act. That there still are not even votes to pass the Republican measure with a simple majority has led to the postponement of the vote that was tentatively slated for next week. One Senator’s recovery from eye surgery is being cited as the ostensible reason for the delay. More revelations about President Trump’s son’s meeting, which now appears to have included a former-Soviet counter-intelligence officer warns of an increasing distraction from the economic agenda. With the Speaker of the House still pressing to include some version of the Border Adjustment Tax, and opposition in the Senate and the White House, skepticism that tax reform can be done this year appears to be growing. |

Economic Events: United States, Week July 17 |

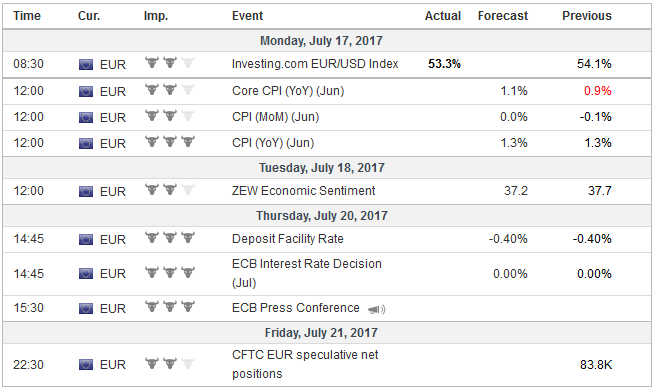

EurozoneThe ECB meeting on July 20 is the most important event next week. It will not change policy. It is unlikely to announce any change in its asset purchases. However, it is likely to continue to evolve its assessment and extend its removal of downside risks by dropping the possibility that it could accelerate its asset purchases if necessary. This has long stopped being pertinent. Nevertheless, in the name of good housekeeping, and for the sake of preparing the investors for tapering, the wording can be adjusted. We expect that presented with new staff forecasts in September, the ECB will use that meeting to announce that it will continue to expand its balance sheet by buying mostly sovereign bonds next year, but at a reduced pace. We suspect a six-month extension will be sought (instead of nine as the length of the current extension) and a pace of 30-40 bln euros a month. There is some risk that it stops buying ABS securities altogether. It does not appear to have been a particularly successful endeavor. Intentional or not, the ECB has spurred a rise in interest rates. Perhaps it is as if the interest rates have been in a pressure cooker and what the ECB managed to do was to release some pressure. The German 10-year yield has risen for three consecutive weeks. It was at 25.5 bp at the close on June 23. Before the weekend, the yield probed near 62 bp before finishing just below 60 bp. Many models project fair value to be closer to 1.0 % if not a bit above. However, fair value models make assumptions about historic relationships that may no longer exist or have been weakened. While ECB officials do not often directly criticize or correct market judgments, we suspect Draghi will reiterate the assessment made at the last meeting: that inflation is not yet on a self-sustaining and durable path toward its target. The ECB does not want a premature tightening of financial conditions. And, yet given the backing up of interest rates and the strengthening of the euro, by some measures, financial conditions are tighter than at end time since the end of 2014. It should not be too surprising if Draghi leans against it. To be clear, we expect the Fed’s balance sheet to shrink by more than $200 bln before the ECB is done with its asset purchases. The Fed may raise rates another two-three times before the ECB can bring its deposit rate out of negative territory. The Bank of Japan is not in the game. In both word and deed, it signaled its intention to resist upward pressure on rates. |

Economic Events: Eurozone, Week July 17 |

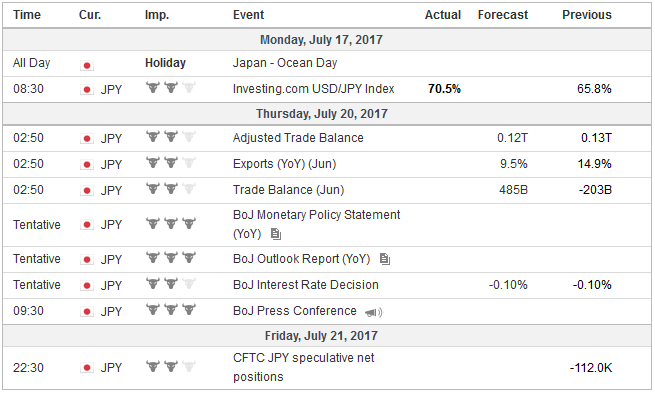

JapanThe BOJ may eventually give in and raise the target if officials believed that the what was driving the increase in global rates was a stronger demand that would also lift the Japanese economy and prices. This week’s BOJ meeting is too early. There is a good reason to be cautious. Japanese prices are only now showing some foothold above zero. There are several sources of uncertainty, including the strength of the US economy and trade policy, the underlying strength of the Chinese economy may be slowing after what appears to be a reasonably strong first half and the trajectory of Japanese fiscal policy given the LDP’s need to shore up support. |

Economic Events: Japan, Week July 17 |

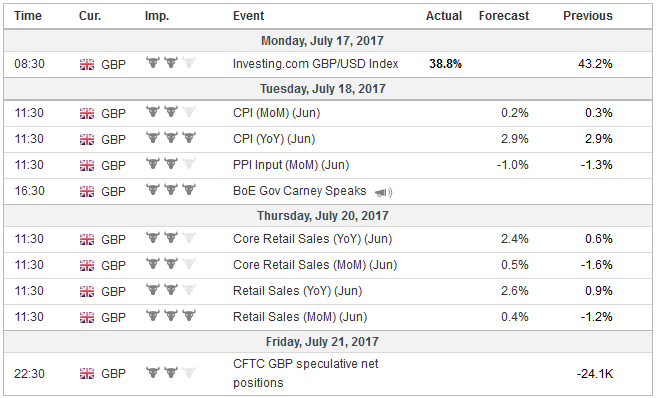

United KingdomDespite sterling’s appreciation, investors harbor serious skepticism of talk that the Bank of England could raise rates at its August 3 meeting. Interpolating from the OIS, the market sees about a one-in-eight chance. The notable thing is that it was less than one percent a month ago. This week’s economic data will offer more evidence for the majority at the MPC that there is no rush to raise interest rates. Many expect UK CPI to have stabilized in June at 2.7%. The risk is asymmetrical. A strong report would not necessarily persuade the MPC, while a weaker report could prompt investors to push down market rates and push sterling lower. The year-over-year pace has not slowed since last year’s referendum in any month but was flat twice. Many expect the spur from the past sharp depreciation of sterling and the oil prices will fall out of the year-over-year comparisons soon. A couple of days later, on July 20, the UK reports retail sales. Some recovery after the sharp 1.6% contraction (excluding auto fuel) in May is expected, but the flatter the bounce, the more sentiment will focus on the squeeze on wages from subdued increases in nominal pay and the still high inflation. Sterling and UK interest rates may be sensitive to any disappointment. |

Economic Events: United Kingdom, Week July 17 |

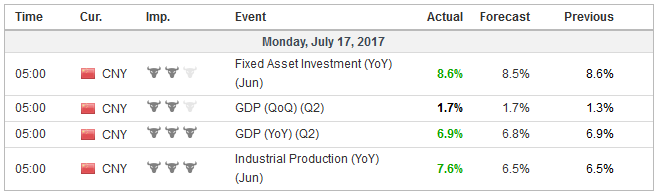

ChinaChina reports Q2 GDP. It is often the first country to report its quarterly growth figure, which rarely deviates from expectations. The Bloomberg survey found a median forecast for a 6.8% year-over-year pace, which would be down slightly from Q1’s 6.9% pace. The PMI reports warn that the world’s second largest economy may have finished Q2 on a down note. Of course, no one expects anything untoward to happen in the economy this side of the high-stakes Party Congress in the fall. Perhaps of greater interest than China’s economic data, which is often seen through the proverbial jaundiced eye, is the end of the 100-day US-China trade talks. There is some indication that this deal-oriented phase can be extended by as long as a year. China has made several concessions to the US, especially in agriculture, and several new deals have been signed, including for soybeans, pork, and beef (for the first time in 14 years). Reports also indicate a more expedited path for biotech products and a likely increase in US natural gas sales. Even though these measures will do very little to reduce the substantial bilateral deficit, the deals appear to have won some good will from the Trump Administration. The Comprehensive Economic Dialogue, which replaces/renames the previous Strategic Economic Dialogue, holds new talks between US Treasury Secretary Mnuchin and China’s Vice Premier Wang Yang. We remain concerned that frustrations in other areas could prompt a more combative approach in areas where the US Administration has great discretion. The US expresses frustration over the lack of sufficient Chinese pressure on North Korea, but agrees to a new high-level arms sale to Taiwan, threatens steel tariffs, sanctions Chinese individuals with business ties to North Korea, asserts freedom of navigation in a project of both naval and aerial force. The yuan has appreciated by about 2.5% against the dollar so far this year. Its reserves have grown for five consecutive months through June, which allows it to return to buying foreign bonds, including US Treasuries. Its trade policies are very much disputed, and the US has scores of anti-dumping duties and levies a range of Chinese products, but presently, as a source of disruption to the global financial markets, the mini-taper tantrum from Europe and the uncertainty surrounding US fiscal policy are eclipsing China. |

Economic Events: China, Week July 17 |

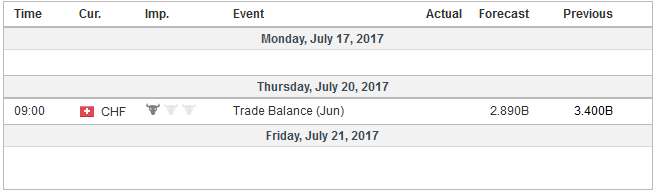

Switzerland |

Economic Events: Switzerland, Week July 17 |

Tags: #GBP,#USD,$CNY,$EUR,$JPY,Featured,newslettersent