Swiss Franc The Euro has fallen by 0.02% to 1.1031 CHF. EUR/CHF - Euro Swiss Franc , July 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week’s gains to more than 2% and reach a new high for the year a little more than %excerpt%.7760. The Canadian dollar is up 1.1% this week, in comparison. The softer yields in European and the US appear to be at flows in Australia, which offers about 45 bp more than the US on two-year money, an 18 bp increase over the past month. The New Zealand dollar cannot keep pace here with its Tasmanian cousin following the

Topics:

Marc Chandler considers the following as important: AUD, CAD, Eurozone Trade Balance, Featured, FX Trends, GBP, Italy Consumer Price Index, newslettersent, NZD, TLT, U.S. Consumer Price index, U.S. Core Consumer Price Index, U.S. Industrial Production, U.S. Michigan Consumer Sentiment, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.02% to 1.1031 CHF. |

EUR/CHF - Euro Swiss Franc , July 14(see more posts on EUR/CHF, ) |

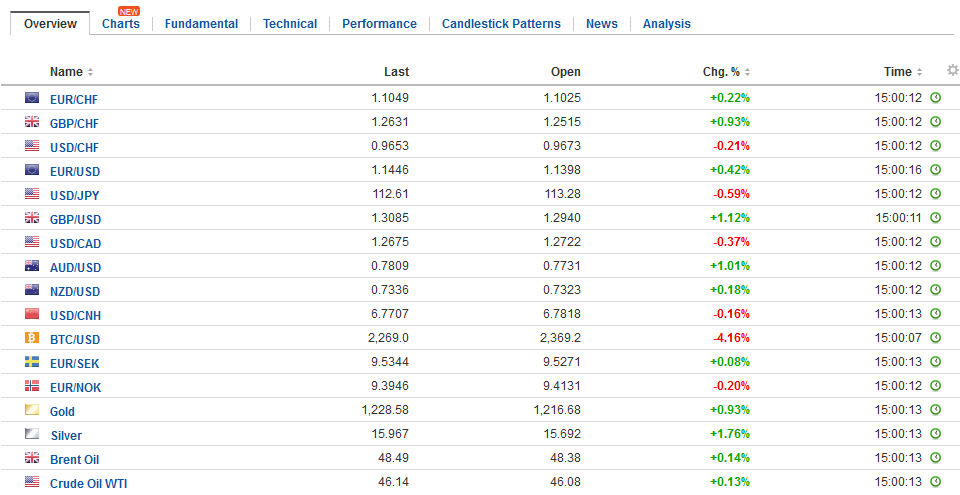

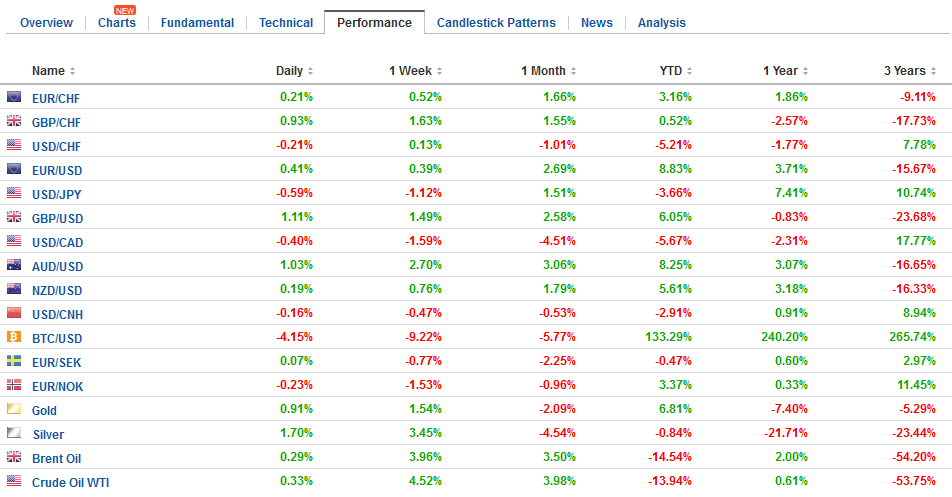

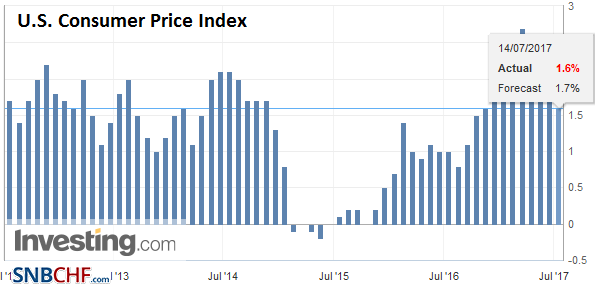

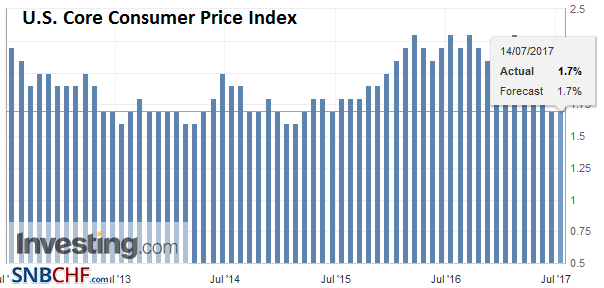

FX RatesThe Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week’s gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is up 1.1% this week, in comparison. The softer yields in European and the US appear to be at flows in Australia, which offers about 45 bp more than the US on two-year money, an 18 bp increase over the past month. The New Zealand dollar cannot keep pace here with its Tasmanian cousin following the disappointing June manufacturing PMI fell to 56.2 in June from a downward revision to the May series (to 58.2 from 58.5). The Australian dollar appears to be breaking out of a bottoming pattern against the New Zealand dollar after underperforming for most of the Q2. After large gains (~1.3%) in the middle of the week in response to the Bank of Canada rate hike, the Canadian dollar is consolidating in narrow ranges. Ahead of the weekend, the chief focus is on the flurry of US economic data that will be reported today. Given investors and policymakers sensitivity to inflation, we have highlighted the importance of today’s CPI report. Core CPI fell for the past four months, and if this trend is arrested in June, as we expect, it could give Yellen instant gratification, and move the flag a bit toward the Fed’s argument about the transitory nature of the recent softening. Despite many insisting that Yellen was dovish, we take seriously the line which the chair repeated in both her sessions, namely that it was “premature” to conclude that underlying inflation was falling short of its target. |

FX Daily Rates, July 14 |

| A few large US banks report earnings today. Investors will also be monitoring developments with the Senate health care reform bill. Two Republican Senators have already come out against it. The challenge is illustrated by the fact that one is a moderate and the other hails from the libertarian wing of the party. Several other Senators are on the fence and waiting for the CBO scoring. The CBO scored the administration’s budget in a similar way that the IMF judged the outlook for the US: slow growth and a higher deficit and more debt.

The week is ending on a firm note for equities. The MSCI Asia Pacific Index finished with a 2.7% gain on the week; its best performance in four months, and new highs for the year. The Hang Seng was the best performing bourse with a 4.1% gain on the week. We note that the Hang Seng China Enterprises Index, which tracks the H-shares, rose 4.65% this week, which is the largest gain since last November. European equities are paring this week’s gains. Modest losses in most sectors, but energy and materials are behind the slippage. |

FX Performance, July 14 |

United StatesA steady or even a small increase in core CPI will not end the debate by any means. The Fed targets the core PCE deflator. One month does not make a trend. In our view, the various Fed comments are consistent with a sequencing that favors beginning of the balance sheet adjustment before the new move on rates. |

U.S. Consumer Price Index (CPI) YoY, June 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

U.S. Core Consumer Price Index (CPI) YoY, June 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

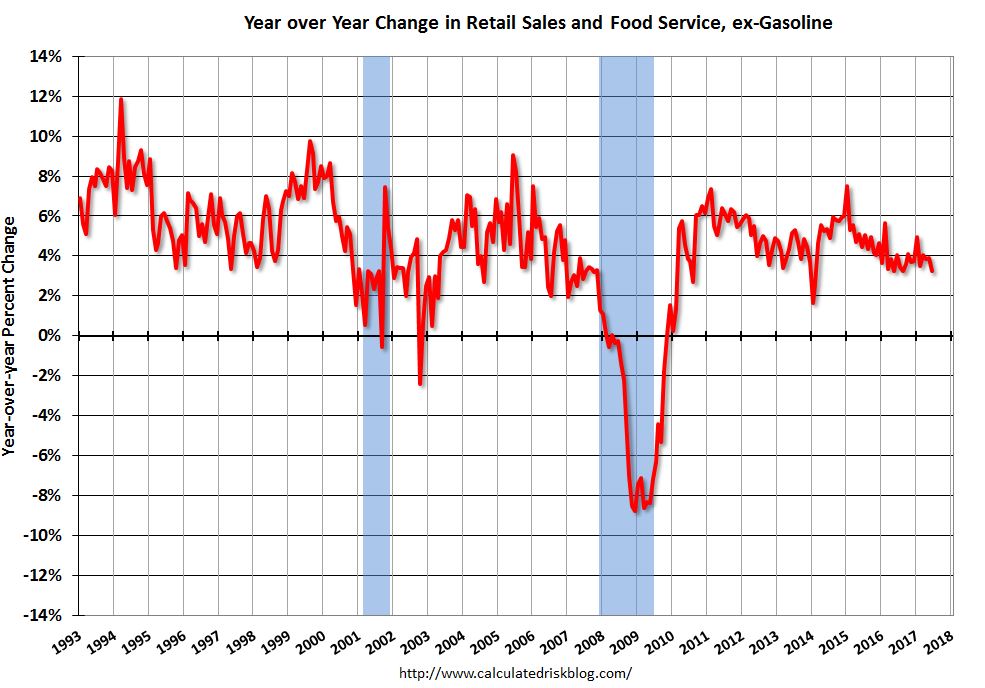

| The US reports June retail sales at the same time as CPI. It may be difficult to determine which the market is reacting most to, but ideally, both reports will point in the same direction. Retail sales are expected to have improved after the 0.3% decline was recorded in May. That said, note that although retail sales are roughly 40% of personal consumption expenditures, the two times series do not always dovetail. In any event, the GDP components of the retail sales report, which excludes items like autos, gasoline and building materials. It was flat in May and is expected to have risen by around 0.3%. The average for the first five months of the year is 0.36% and last year’s average was 0.23%. |

U.S. Retail Sales YoY, June 2017(see more posts on U.S. Retail Sales, ) Source: macro.economiblogs.org - Click to enlarge |

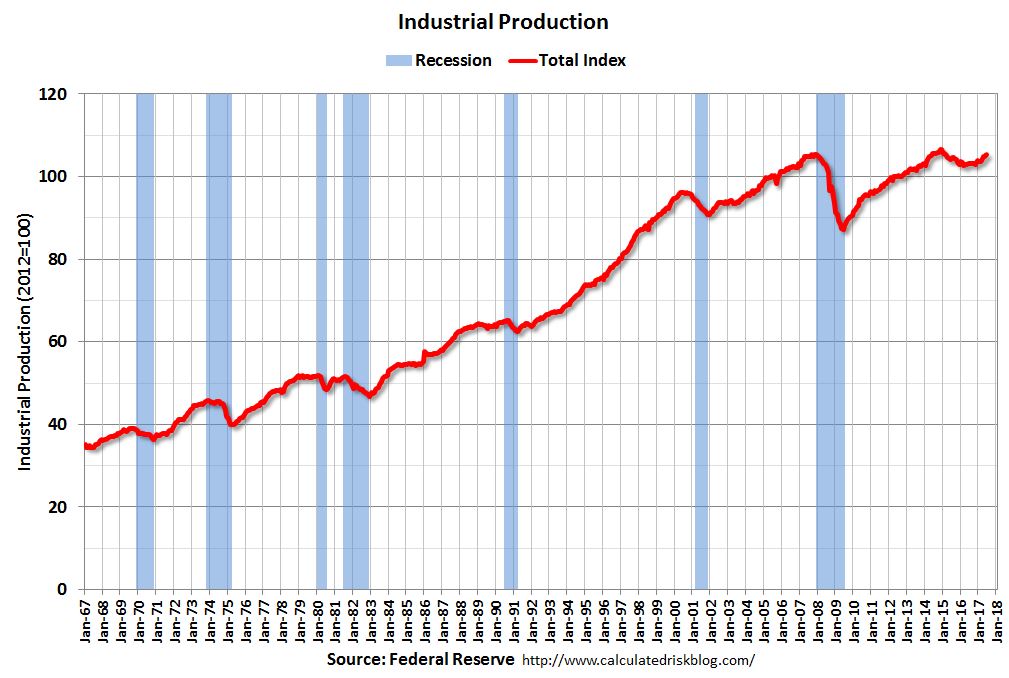

| Also, June industrial production figures will be released shortly after the CPI and retail sales. Industrial production and manufacturing output are also expected to have improved from May. Industrial production is expected to increase by 0.3% after a flat reading, and manufacturing output can recover some of the 0.4% decline posted in May. We note that capacity utilization peaked in late 2014 a little below 80%. It stood at 76.6% in May. The relatively low capacity utilization may speak to the subdued investment in plant and equipment, as well as the modest price pressures. |

U.S. Industrial Production YoY, June 2017(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

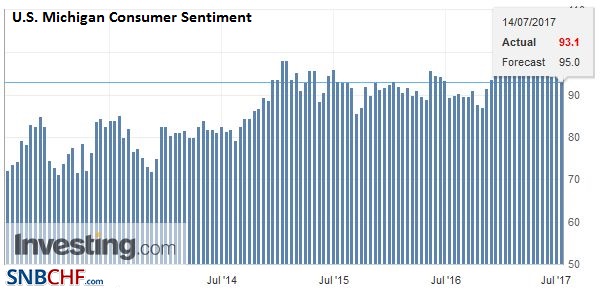

U.S. Michigan Consumer Sentiment, July 2017 (flash)(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

|

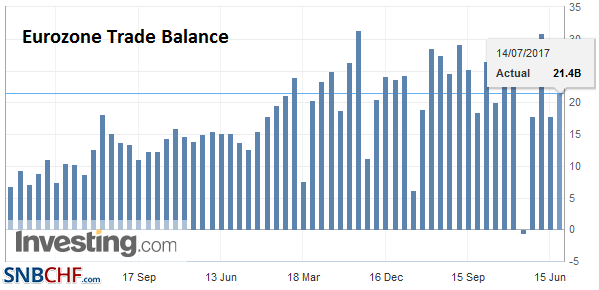

EurozoneEuropean bonds are firm, and the mini-taper tantrum appears to have eased. Outside of Germany, where the 10-year yield is up four basis points in the week, other countries’ including France, Holland, Italy, Spain, Portugal, and Greece have seen yields ease this week. The ECB meets next week. At most, it is expected to tweak its forward guidance and remove the assurances that asset purchases can be increased if necessary. In September, we expected the ECB to announce an extension of its purchases into next year while tapering the amount. |

Eurozone Trade Balance, May 2017(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

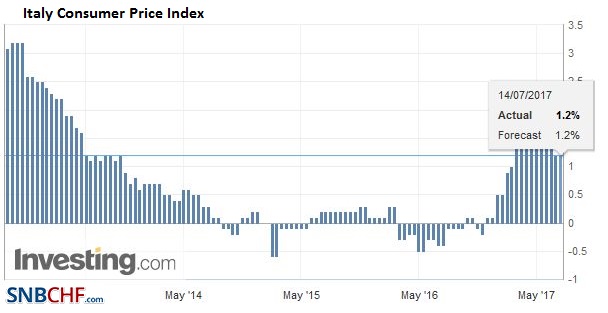

Italy |

Italy Consumer Price Index , June 2017(CPI) YoY(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United Kingdom

Sterling is firm, at new highs for the week near $1.2970. It bottomed in the middle of the week just ahead of $1.2810. Last week it reached almost $1.30. The UK reports June CPI next week and retail sales. The latter is expected to have fallen, but the median in the Bloomberg survey shows steady inflation. We expect sterling to be particularly sensitive to inflation and any softening could further dampen rate hike pressure.

Separately, we see the UK Brexit stance as gradually capitulating to the EU. The UK has been forced to accept that the divorce negotiation precedes talks of a new agreement. In apparent contrast to UK Foreign Secretary Johnson’s suggestion earlier this week that the EU could “go whistle” if it expected the UK to be paying the EU after the amputation, UK Brexit Secretary Davis, who is seen as a possible successor to Prime Minister May, appears to have accepted the obligation (“financial settlement”). This is seen as a potential softening of the UK stance, but we continue to warn against a soft Brexit, which has meant access to the single market while parting from the free movement and other freedoms (EU red lines).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$TLT,Eurozone Trade Balance,Featured,Italy Consumer Price Index,newslettersent,NZD,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Industrial Production,U.S. Michigan Consumer Sentiment,U.S. Retail Sales