Politicians around the world are working hard to build this emerging prison planet. But it’s still possible to escape. We recently released a video to show you how. Click here to watch it now. If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone. Few people have, and even fewer fully grasp the terrible things it foreshadows. FATCA is a U.S. law that forces every financial institution in the world to give the IRS information about its American...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »State Of Fear – Corruption In High Places

Submitted by Pater Tenebrarum via Acting-Man.com, Mr. X and his Mysterious Benefactors As the Australian Broadcasting Corporation (ABC) reports, a money-laundering alarm was triggered at AmBank in Malaysia, a bank part-owned by one of Australia’s “big four” banks, ANZ. What had triggered the alarm? Money had poured into the personal account of one of the bank’s customers, a certain Mr. X, in truly staggering amounts. A recent photograph of Mr. X. Hundreds of millions of dollars were...

Read More »Futures Jump On Chinese Trade Data; Oil Declines; Global Stocks Turn Green For 2016

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation. It got that courtesy of the return of USDJPY levitation, which has pushed the pair back above 109, the highest in over a week, as well as a boost in sentiment from the previously reported Chinese trade data where...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

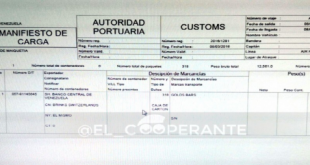

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another...

Read More »Areva: Phagocytage et déclin économique. Liliane Held-Khawam

Le phagocytage de la production française bien avancé Too big to fail. Ce sont des établissements financiers que l’État juge trop grands pour faire faillite. Ils sont privés? Ils sont mal gérés? Ils sont manipulés par des tiers étrangers? Leur substance est siphonnée? Les emplois ont été délocalisés? On ne sait pas qui gère quoi et surtout où va l’argent? Aucune importance. L’État brave et transgresse les règles les plus élémentaires de l’économie libérale et y injecte des sommes...

Read More »USA: The New Switzerland?

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html USA: The New Switzerland? Written by Jeff Thomas (CLICK FOR ORIGINAL) At one time, tax havens took great pride in calling themselves just that, since low-tax jurisdictions provide people with freedom from oppressive taxation. But, in recent decades, the...

Read More »Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org