A report by the Federal Finance Administration anticipates lower net revenues for all levels of government. … demographic-related expenditure will increase from 17.2% of gross domestic product (GDP) to 19.8% of GDP by 2060. If no reforms are made, public debt would rise from the current 27% to 48% of GDP. The need for reform is particularly pronounced at federal (including social security) and cantonal level. While AHV expenditure in particular poses a challenge for the Confederation,...

Read More »“Dynamic Tax Externalities and the U.S. Fiscal Transformation,” JME, 2020

Journal of Monetary Economics, with Martin Gonzalez-Eiras. PDF. (Appendix: PDF.) We propose a theory of tax centralization in politico-economic equilibrium. Taxation has dynamic general equilibrium implications which are internalized at the federal, but not at the regional level. The political support for taxation therefore differs across levels of government. Complementarities on the spending side decouple the equilibrium composition of spending and taxation and create a role for...

Read More »“Dynamic Tax Externalities and the U.S. Fiscal Transformation,” JME

Accepted for publication in the Journal of Monetary Economics, with Martin Gonzalez-Eiras. PDF. (Appendix: PDF.) We propose a theory of tax centralization in politico-economic equilibrium. Taxation has dynamic general equilibrium implications which are internalized at the federal, but not at the regional level. The political support for taxation therefore differs across levels of government. Complementarities on the spending side decouple the equilibrium composition of spending and...

Read More »“Dynamic Tax Externalities and the U.S. Fiscal Transformation,” JME

Accepted for publication in the Journal of Monetary Economics, with Martin Gonzalez-Eiras. PDF. (Appendix: PDF.) We propose a theory of tax centralization in politico-economic equilibrium. Taxation has dynamic general equilibrium implications which are internalized at the federal, but not at the regional level. The political support for taxation therefore differs across levels of government. Complementarities on the spending side decouple the equilibrium composition of spending and...

Read More »“Fiscal Federalism, Grants, and the U.S. Fiscal Transformation in the 1930s” UoCH, 2017

University of Copenhagen, Department of Economics Discussion Paper 17-18, July 2017, with Martin Gonzalez-Eiras. PDF. We propose a theory of tax centralization and intergovernmental grants in politico-economic equilibrium. The cost of taxation differs across levels of government because voters internalize general equilibrium effects at the central but not at the local level. The equilibrium degree of tax centralization is determinate even if expenditure-related motives for centralization...

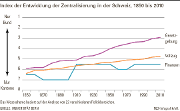

Read More »Federalism Trends in Switzerland

In the NZZ, Sean Müller und Paolo Dardanelli report about long-term trends in the Swiss federalist structure. Legislation has become more centralized. Implementation less so. Cantons increasingly implement federal legislation. But decentralized authority to collect taxes has remained largely in place. Figure from the NZZ:

Read More »Swiss Cantons Loose Revenue When Firms Move In

In an interview with the NZZ, Christoph Schaltegger argues that Swiss cantons loose revenue when new firms move in, due to badly structured inter cantonal revenue sharing (Finanzausgleich).

Read More »Redistribution at the EU Level

On VoxEU, Paolo Pasimeni and Stéphanie Riso argue that at the EU level, cross-border redistribution is limited: The EU budget accounts for roughly 1% of the EU’s GDP. Around 80% of it, on average, returns back to each country in the form of various allocated expenditures, and only a limited part is actually redistributed among countries. On average over the past 15 years, the redistribution operated by the budget at the level of the EU was equal to 0.2% of the Union’s GDP. As a matter of...

Read More »“Causes of the Transformation of the US Fiscal System in the 1930s,” VoxEU, 2016

VoxEU, October 11, 2016, with Martin Gonzalez-Eiras. HTML. The US fiscal system underwent a radical transformation around the time of the Great Depression. Perceived cost differences of revenue collection across levels of government, due to general equilibrium effects, can partly explain the rise of tax centralization and intergovernmental grants. We develop a micro-founded general equilibrium model that blends politics and macroeconomics. (See the working paper.)

Read More »“Fiscal Federalism, Taxation and Grants,” CEPR, 2016

CEPR Discussion Paper 11482, August 2016, with Martin Gonzalez-Eiras. PDF. Also published as CESifo Working Paper 6062, Study Center Gerzensee Working Paper 16-05. PDF, PDF. We propose a theory of tax centralization and inter governmental grants in politico-economic equilibrium. The cost of taxation differs across levels of government because voters internalize general equilibrium effects at the central but not at the local level. This renders the degree of tax centralization and the tax...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org