Swiss hotels and holiday apartments are raising their prices by around 5% this winter, largely due to higher energy prices. Ski passes are also likely to go up by a similar amount, a newspaper reports. According to a survey by the Hotelleriesuisse association, seen by NZZ am Sonntag, most Swiss hotels are planning to pass on the higher costs of electricity, gas and oil to their guests. Three-quarters of all hotels expect to raise prices this winter compared to the...

Read More »November 2022 Monthly

With this month's hike, the Federal Reserve would have raised overnight rates by 300 bp while doubling the pace that its balance sheet is shrinking over the past 100 days. The US economy is the largest in the world, and US interest rates and the dollar are vital benchmarks. America's centrality remains in what has been dubbed a G-Zero world, even if its share of the world economy is a bit less than it used to be, or the dollar's share of global reserves has been...

Read More »Without Easy Money from the Fed, Home Prices Will Keep Falling

Home price growth of the sort we’ve seen in recent years simply cannot be sustained without a continued commitment to easy money from the central bank, and it shows. Home prices continued to slide in August as the economy cooled, and as the Fed hit the Pause button on quantitative easing while allowing interest rates to rise. Home prices in August were 13.0 percent higher nationally compared with August 2021, according to newly released data from the S&P...

Read More »Credit Suisse turns to petrodollars to fund turnaround

Credit Suisse is banking on petrodollars from Saudi Arabia to shore up its precarious situation. Keystone / Oliver Berg Swiss bank Credit Suisse has returned to the Middle East to shore up its finances amid mounting losses and a deteriorating balance sheet. In the aftermath of the 2008 financial crisis, Qatar’s sovereign wealth fund, the Qatar Investment Authority, built up a 5% stake in Switzerland’s second largest bank. Now the Saudi National Bank has accepted...

Read More »Latest Recession Alarm: Money-Supply Growth Fell in September to a 37-Month Low

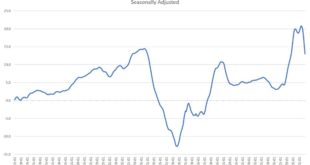

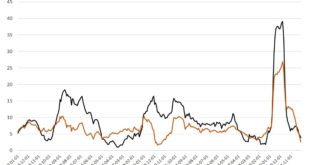

Money supply growth fell again in September, dropping to a 37-month low. August’s drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the “high” levels experienced from 2009 to 2013. During September 2022, year-over-year (YOY) growth in the...

Read More »RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.Let us preview the data before turning to the central banks. Yet the challenge with the data is that the underlying macro views are...

Read More »5.000 neue Cryptocoins in 2022 widerlegen These vom Ende des Cryptomarktes

Zugegeben, das aktuelle Jahr ist nicht das Jahr des Cryptomarktes. Angeführt vom Bitcoin verloren die meisten Cryptocoins in diesem Jahr deutlich an Wert – im Falle des BTC sind es mehr als zwei Drittel. Doch der Markt ist weiterhin ein heißes Eisen, wie die 5.000 neuen Cryptocoins, die dieses Jahr bereits entstanden, belegen. Crypto News: 5.000 neue Cryptocoins in 2022 widerlegen These vom Ende des CryptomarktesDer Markt befindet sich in einer Bärenphase, doch die...

Read More »Swiss pandemic costs lower than feared

Switzerland’s budget faces a sizeable deficit despite fewer pandemic costs than expected. Keystone / Gaetan Bally The coronavirus pandemic will have a lighter impact on Swiss state finances than previously feared but will still put the country’s budget in the red, the finance ministry forecasts. Measures to support companies and workers during the pandemic were expected to cost CHF7.4 million ($7.4 billion) during the last forecast in June. But on Wednesday, the...

Read More »Is Central Banks’ License to Print Money About to Expire?

One of the biggest reasons for people deciding to buy gold bars or to own silver coins is because of the folly of central banks and government. It seems bizarre to most people that we are all aware that money doesn’t grow on trees and yet those responsible for financial stability have forgotten this basic life-lesson. But, what has felt even more bizarre (and maddening) is for how long this foolishness has been allowed to continue. Well, it seems this won’t be the...

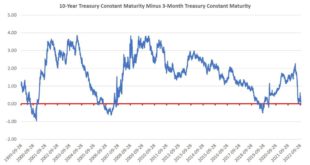

Read More »This Is Why the Yield Curve Just Inverted, Signaling a Coming Recession

In recent decades, every instance in which the economy contracted two quarters in a row has coincided with a recession. Nonetheless, the Biden Administration and the leadership at the Federal Reserve insist there is no recession now, nor is one even in the works. On the other hand, declining GDP growth, rising credit card debt, disappearing savings, and falling disposable income all point to recession. And now one of the most closely watched recession indicators is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org