Secularists cheer the decline of religion in Western societies, but that loss comes at a huge cost: the decline of civilization itself. Original Article: "Loss of Religious Belief Is a Greater Loss for a Civilized Society" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags:...

Read More »Wie viele Arbeitsjahre bis zur Traumwohnung notwendig sind

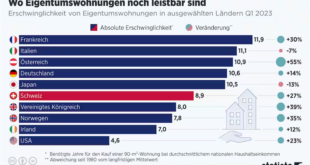

Viele Menschen in der Schweiz können sich Wohneigentum nicht leisten. Und wer es kann, muss länger sparen als früher. Die Preise für Wohneigentum haben sich in den letzten zwanzig Jahren fast immer in die gleiche Richtung entwickelt. Nach oben – und zwar ziemlich steil. Sogar jetzt, nachdem die Nationalbank schon dreimal den Leitzins erhöht hat, sind Einfamilienhäuser und Eigentumswohnungen nicht merklich günstiger geworden – um lediglich 0,2 Prozent gingen die...

Read More »China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

It is easy to dismiss Chinese advancements in electric vehicles as the result of government subsidies, but private entrepreneurship also is playing a major role. Original Article: "China's Emerging Global Leadership Isn't Just the Result of Subsidies: Entrepreneurship Still Matters in This Market" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Artificial Intelligence Can Serve Entrepreneurs and Markets

In our technocratic age, it is easy to dismiss the latest technological developments as an avenue toward freedom, but some of them still bode well for markets. Original Article: "Artificial Intelligence Can Serve Entrepreneurs and Markets" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »US Jobs, Kuroda’s Last BOJ Meeting, and Powell’s Congressional Testimony Highlight the Week Ahead

The dollar peaked last September/October and trended lower until the January jobs report and strong service ISM on February 3. These reports and firm inflation readings, owing, at least in part, to benchmark and methodological changes, helped spur the greenback's recovery. However, we learned last week that auto sales and the service ISM prices paid decelerated in February, and this week, we will learn that job growth has slowed considerably. If accurate, the median...

Read More »The Fed’s “Disinflation” Story Just Flew Out the Window

Mark talks about the recent price inflation reports, as well as reports of job openings from private sector job placement companies. Inflation was higher than expected and job openings declined. What will the Fed do? People are making painful adjustments—Domino's reported disappointing sales, because their customers are "eating in". Be sure to follow Minor Issues at Mises.org/MinorIssues. [embedded content]...

Read More »Altruism vs. Materialism in Market Exchange

[Excerpted from chapter 6 "Antimarket Ethics: A Praxeological Critique" of Power and Market.] One of the most common charges levelled against the free market (even by many of its friends) is that it reflects and encourages unbridled “selfish materialism.” Even if the free market—unhampered capitalism—best furthers man's “material” ends, critics argue, it distracts man from higher ideals. It leads man away from spiritual or intellectual values and atrophies any...

Read More »Austrian Economics Stands against the Collectivism of Progressive Thought

Recently, I published an article in the Mises Wire, “Woke Egalitarianism and the Elites,” in which I presented the true intentions behind woke egalitarianism. The article also described how elites attempt to rebuild society through collectivism. But more than discussing the goals of progressivism, we need to discuss the intellectual basis of these attempts. What assumptions and intellectual framework guide these actions? Progressivism is based on a disrespect of...

Read More »The “great Ponzi scheme” coming to an end?

In a recent conference, the EU’s Commissioner for Cohesion and Reforms, Elisa Ferreira, gave a dire warning: “We have a shrinking workforce all across Europe, all countries are losing their workforce.” Indeed, in just 10 years, the EU lost 5 million people in the working-age population, as the most recent report on demographic change by the Commission showed. The report revealed other interesting data and trends too. For example, it showed that over a third...

Read More »Losing Control of Money

With global worldwide debt now over $300 trillion and interest rates rising, the US dollar is once again a relative safe haven in a slowing economy. Currencies competing with the Dollar face a deadly race to stave off a sovereign debt crisis. Is the dollar now unbound, as the dominant political tool of the dominant nation? The Dollar Milkshake Theory: Mises.org/HAP385a Thorsten Polleit, The Global Currency Plot: Mises.org/HAP385b Bob's book, Understanding Money...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org