In an excellent display of how US foreign policy can be used as a means of pandering to domestic interest groups, the Biden administration has threatened to impose sanctions on Uganda as punishment for that regime's adoption of new laws criminalizing some types of homosexual behavior. While it is abundantly clear that this move from the Ugandan state presents absolutely no threat to any vital US interest, the Biden administration apparently believes the situation...

Read More »Banks Are Lending Less Money, and That’s a Formula for Recession

A new Fed survey shows that banks are cutting back on lending big time. Over the past thirty-five years, this almost always predicts recession. Our economy can't survive without endless new infusions of easy money. Original Article: "Banks Are Lending Less Money, and That's a Formula for Recession" [embedded content]...

Read More »Is the US Banking Crisis Over? It Has Barely Begun

According to some commentators, the US banking crises is over, or at least can be easily managed by the Federal Reserve System. In addition, the Fed chairman has vouched for the health of the US banking sector. However, the banking crisis is likely in its early stages. What has started as the collapse of regional banks is likely to spread to national banks. The key reason for that is the decline in the pool of savings and continuation of fractional reserve lending in...

Read More »US Debt Ceiling Drama Ends with a Whimper, Focus on US Jobs and Fed

Overview: Another bizarre US debt-ceiling episode is over. President Biden will sign the bill that was approved by the Senate late yesterday. It is a bit anticlimactic for the market, for which the US jobs data is the key focus now. Outside of the fiscal drama, the Federal Reserve leadership has effectively push against market expectations for a hike later this month. The odds were around 70% earlier this week, and ahead of the jobs report, is near 30%. The dollar's...

Read More »Swiss Banks Unlikely to Migrate to Blockchain, DLT Systems, Says SNB Advisor

While some banks have started experimenting with blockchain and distributed ledger technology (DLT), widespread migration to these systems are unlikely to occur due to a number of roadblocks, including regulatory and compliance challenges, the high costs of the endeavor, as well as uncertainties about the long-term benefits and potential disruption of the technology on existing business models, Benjamin Müller, an advisor on banking operations for the Swiss National...

Read More »Government Redistribution Is the REAL Trickle-Down Economics

President Biden recently claimed that "trickle-down economics" doesn't work but transferring wealth from taxpayers to politically connected people is the real trickle-down economics. Original Article: "Government Redistribution Is the REAL Trickle-Down Economics" [embedded content] Tags: Featured,newsletter

Read More »The Attack on the Western Tradition

[This article is adapted from a lecture delivered at the Reno Mises Circle in Reno, Nevada. on May 20, 2023.] We are faced today with a concentrated attack on the great thinkers of the Western tradition, who are dismissed as “dead white European males.” Robert Nozick used to say that what offended him most in this phrase was the word “dead.” It’s not nice to beat up on people who can’t fight back because they are no longer here! But the attack I’m talking about is no...

Read More »A Rothbardian History of the United States

In this episode of Radio Rothbard, Ryan McMaken and Tho Bishop take a revisionist Rothbardian lens to American history. Was the American revolution a good thing? Was Andrew Jackson better than Thomas Jefferson? Does a historical narrative really matter? Tune in for this and more! [embedded content] New Radio Rothbard mugs are now available at the Mises Store. Get yours at Mises.org/RothMug PROMO CODE: RothPod for 20% off [embedded content]...

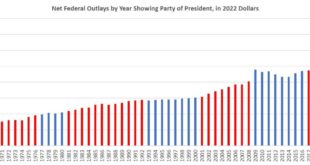

Read More »The Real Costs of Government Spending

In this episode of Good Money, Tho Bishop is joined by Dr. Jonathan Newman to discuss the real costs of government spending. The end of the debt ceiling battle has resulted in the predictable outcome of normalizing the fiscal insanity of covid-era spending. Tho and Jonathan discuss how this was predictable to those familiar with the work of Dr. Robert Higgs, how mainstream GDP measures miss the true costs of government, and alternative approaches Austrian economists...

Read More »The Republican Debt-Ceiling “Deal” Is Exactly What We Expected

After countless predictions of economic armaggeddon and panicky entreaties to raise the debt ceiling with no strings attached, the Biden White House and Congressional Republicans agreed on a new budget deal this week that does virtually nothing at all to change the status quo. The deal in no way returns federal spending to pre-covid levels. At best, the deal does "limit" spending by placing tentative caps on spending which—assuming they are not abandoned in the face...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org