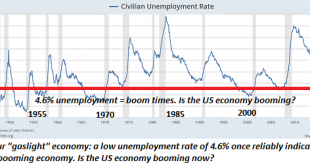

If you don’t like what these charts are saying, please notify The Washington Post to add the St. Louis Federal Reserve to its list of Russian propaganda sites. Yesterday I described our gaslight financial system. Today we’ll look at our gaslight economy. Correspondent Jason H. alerted me to the work of author Thomas Sheridan ( Puzzling People: The Labyrinth of the Psychopath), who claims to have coined the...

Read More »Greek Bonds may Soon be Included in ECB Purchases

Summary: The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece’s debt is sustainable, but the IMF disagrees. The ECB does not include Greek bonds in its sovereign bond purchase operation. However, the progress is being made, and it is possible that starting early next...

Read More »Gold Price Skyrockets in India after Currency Ban – Part V

A Brief Recap India’s Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes will no longer be legal tender. Linked are Part-I, Part-II, Part-III, and Part-IV, which provide updates on the rapidly encroaching police state. Expect a continuation of new social engineering notifications, each sabotaging wealth-creation, confiscating people’s wealth, and tyrannizing those who refuse to be a part...

Read More »November 2016: Swiss consumer price inflation remain lowest compared to Eurozone and U.S.

Swiss consumer price inflation remain lowest compared to Eurozone and U.S. Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and...

Read More »FX Daily, December 06: You Can Almost Hear a Pin Drop

Swiss Franc EUR/CHF - Euro Swiss Franc, December 06(see more posts on EUR/CHF - Euro Swiss Franc, ) - Click to enlarge FX Rates The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback’s downside correction after strong gains last month may not be...

Read More »Dang It! Gold was Supposed to Go Up! Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Plethora of Reasons We’ve gone through a succession of events and processes that were supposed to make gold go up. The following list is by no means exhaustive: Quantitative Easing Bernanke’s Helicopter Drops Janet Yellen’s Keynesianism Obama’s Deficits (US government debt is now a hair away from $20,000,000,000—and...

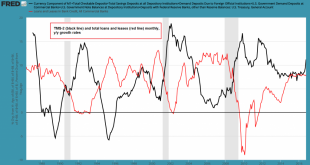

Read More »US True Money Supply Growth Jumps, Part 1: A Shift in Liabilities

A Very Odd Growth Spurt in the True Money Supply The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is...

Read More »Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top. Since the US election nearly a month ago, the Japanese yen has been the weakest performing major currency. It has fallen 7.5% against the US dollar. At the risk of oversimplifying, there is one major drag on the yen, and that...

Read More »Great Graphic: Dollar Index Update

Summary: The Dollar Index’s technical tone has deteriorated. It is corresponding to the easing of US rates and a narrowing differential. The risk is that the correction can continue in the coming days. We took a closer look at the US Dollar Index last week. In our write up, we noted highlighted the importance of the 100.60 area. We warned that a break of that support could signal the start of a deeper...

Read More »FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

Swiss Franc EUR/CHF - Euro Swiss Franc, December 05(see more posts on EUR/CHF, ). - Click to enlarge FX Rates After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org