In the NZZ, René Höltschi reviews the Greek debt crisis since October 2009.

Read More »Nine Years of Greek Debt Crisis

In the NZZ, René Höltschi reviews the Greek debt crisis since October 2009.

Read More »Redenomination Risk in the Eurozone

In a CEPR discussion paper Christian Bayer, Chi Kim, Alexander Kriwoluzky analyze redenomination risk during the European debt crisis and how the European Central Bank’s interventions affected this risk. They conclude that the risk fell in the case of Italy but increased for France and Germany. From the abstract: … first estimate daily default-risk-free yield curves for French, German, and Italian bonds that can be redenominated and for bonds that cannot. Then, we extract the compensation...

Read More »ECB Bond Purchases: Fiscal or Monetary Policy?

In an NBER working paper, Arvind Krishnamurthy, Stefan Nagel, and Annette Vissing-Jorgensen analyze which components of bond yields were affected by the European Central Bank’s government bond purchasing programs. Given the institutional restrictions on monetary policy in the Euro area, the ECB had to carefully argue why it intervened in the first place. (To many, the case was obvious; the ECB intervention amounted to quasi-fiscal policy. But an intervention with this objective would not...

Read More »Price Effects of Purchases of Greek Sovereign Debt by the ECB

In a CEPR discussion paper, Christoph Trebesch and Jeromin Zettelmeyer argue that ECB bond buying had a large impact on the price of short and medium maturity bonds … However, the effects were limited to those sovereign bonds actually bought. We find little evidence for positive effects on market quality, or spillovers to close substitute bonds, CDS markets, or corporate bonds. A multiple equilibria view of the crisis would probably suggest otherwise.

Read More »“Monetary Economic Issues Today,” Panel, 2017

Panel discussion with Ernst Baltensperger, Otmar Issing, Fritz Zurbrügg and Mark Dittli (moderator) on the occasion of the publication of the Festschrift in honour of Ernst Baltensperger, Bern, June 16, 2017. SNB press release. Video (SNB Forschungs-TV).

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

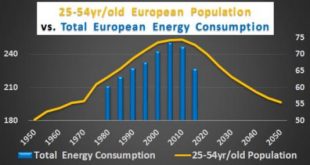

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

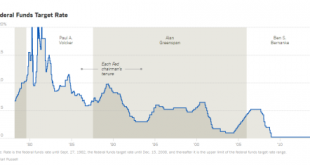

Read More »Are Rate Hikes Bad For Gold?

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

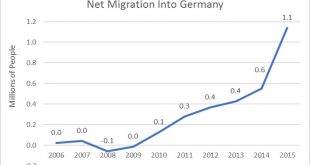

Read More »Martin Armstrong: “EU in Disintegration Mode”

Martin Armstrong Frames the Issue Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong’s piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that, “The EU leadership is really trying to make Great Britain pay dearly for voting to exit the Community. Like the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org