Gold in 2023 Will Be Driven by Real Rates A Fed pivot is to be expected in 2023, according to today’s guest Mike Singleton. Mike is Senior Analyst at Invictus Research and joins us for the first time, here on GoldCore TV. [embedded content] In his chat with our host Dave Russell, Mike gives us his thoughts on inflation, the US Dollar and what the future holds for gold and silver prices. You’ll hear why Mike thinks that real rates are the key for us to look out for to...

Read More »Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

So Ben Bernanke has won a Nobel Prize for kicking a can down the road! Many will have heard the saying ‘those who do not learn from history, are doomed to repeat it’. It is often attributed to Churchill, but he was in fact quoting George Santanya. We prefer the Stephen Hawking quote, ‘“We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.” as this feels more apt in this day and age. Below we outline the Nobel-prize...

Read More »Rick Rule – Gold Helps Me Sleep at Night

“The US dollar’s strength isn’t so much a function of the strength of the US economy or US political leadership, but rather, the fact that we’re competing in a horse race against a bunch of other horses that are completely lame.” Rick Rule – Rule Investment Media The former President and CEO of Sprott, was last on the show at the beginning of February, so it’s an understatement to say he and GoldCore TV host Dave Russell had a few things to catch up on! From US...

Read More »“The British people are politically homeless – Part II”

Interview with Godfrey Bloom: Part II of II (click on this link for Part I) Claudio Grass (CG): With everything that’s been going on, it could be argued that very few of Liz Truss’s predecessors had worse luck in their first month in office. The Queen’s death dominated international mainstream media for weeks and it reignited a lot of old debates about Britain’s past and about the monarchy itself. What is your own view on the monarchy? Is it just a useless relic and a burden on...

Read More »“The British people are politically homeless – Part II”

Interview with Godfrey Bloom: Part II of II (click on this link for Part I) Claudio Grass (CG): With everything that’s been going on, it could be argued that very few of Liz Truss’s predecessors had worse luck in their first month in office. The Queen’s death dominated international mainstream media for weeks and it reignited a lot of old debates about Britain’s past and about the monarchy itself. What is your own view on the monarchy? Is it just a...

Read More »“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid crisis has been downplayed,...

Read More »“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid crisis has been downplayed, or often gone...

Read More »Physical Gold & Why I Hold it – Bubba Horwitz

Founder and CEO Todd Bubba Horwitz joins GoldCore TV’s Dave Russell to discuss the Great Reset, physical gold investment forthcoming stagflation . This is Bubba’s first appearance on GoldCore TV , and we’re delighted to welcome him. When Dave spoke to Bubba, they covered a lot of ground: from the rock and a hard place that the Fed finds itself in, to the impact on the housing market, the Green New Deal, the oil price and, of course, the price of both gold and...

Read More »Crypto and the Environment

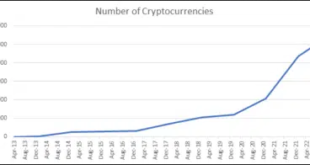

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result. The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition...

Read More »Were the UK pension funds just the canary in the gold mine?

This week we ask if the wobble experienced by UK pension funds, last week, was just the canary in the gold mine for the global economy. If not for other central banks then this was certainly a reminder for individuals, who were prompted to ask about the levels of counterparty risk their savings and pensions were exposed to, and how they might better protect themselves in the coming months and years. UK pension funds’ lack of liquidity is only the first fault line in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org