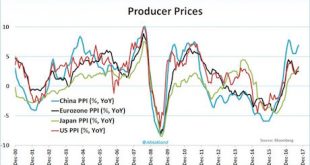

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

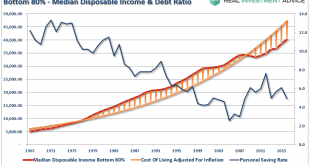

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

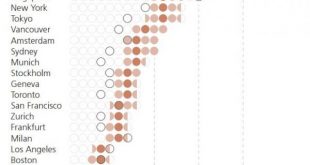

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be...

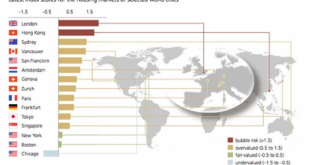

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. UBS Global Real Estate Bubble Index - Click to enlarge What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s...

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be day traded to satisfy their gambling habits. But, thanks to the...

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to...

Read More »Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org