– Global debt bubble may be understated by $13 trillion: BIS – ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’ – Risk of new liquidity crunch and global debt crisis – “The debt remains obscured from view…” warn BIS Global debt may be under-reported by around $13 trillion because traditional accounting practices exclude foreign exchange derivatives used...

Read More »Global Debt Bubble Understated By $13 Trillion Warn BIS

– Global debt bubble may be understated by $13 trillion: BIS – ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’ – Risk of new liquidity crunch and global debt crisis – “The debt remains obscured from view…” warn BIS Global debt may be under-reported by around $13 trillion because traditional accounting practices exclude foreign exchange derivatives used...

Read More »Bitcoin Price Falls 40percent In 3 Days Underling Gold’s Safe Haven Credentials

– Bitcoin price action shows cryptos vulnerable to commentary and government policies– Bitcoin falls to low of $2,980, down by $1,000 in week as China flexes muscles– Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows– BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven– Apple and Google developing a payment API for cryptos – may give governments full...

Read More »Gold Up, Markets Fatigued As War Talk Boils Over

North Korea threatens to reduce the U.S. to ‘ashes and darkness’ Markets becoming used to ongoing provocations from North Korea Russia and China continue to support watered down versions of sanctions on Kim’s regime Both NATO and Russia running war games on one another’s borders Putin says Russia will “give a suitable response” to NATOs threatening behaviour Gold set to climb as fears over economy and war will drive...

Read More »Oil Rich Venezuela Stops Accepting Dollars

President Maduro ” Venezuela will create a basket of currencies to free us from the dollar,” Oil traders ordered to stop accepting U.S. dollar in exchange for crude oil Order comes following calls from Russia and China to find alternatives to current reserve system U.S. Dollar accounts for two-thirds of global trade Venezuela has over ten-times more oil than United States Super powers are gradually turning to gold to...

Read More »British People Suddenly Stopped Buying Cars

– British people suddenly stopped buying cars – Massive debt including car loans, very low household savings – Brexit and decline in sterling and consumer confidence impacts – New cars being bought on PCP by people who could not normally afford them – UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley – Bank of England is investigating to make sure UK banks...

Read More »Buy Gold for Long Term as “Fiat Money Is Doomed”

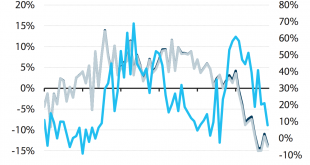

– Buy gold for long term as fiat money is doomed warns Frisby– Gold’s “winning streak” will continue in long term– September is traditionally a good month for gold, as we head into the Indian wedding season– “It’s just a matter of time before gold comes good again…”by Dominic Frisby, Money Week Today folks, by popular demand, we’re talking gold. It’s had a nice summer run. What now? Gold Daily, Jul 2010 - Oct 2017(see...

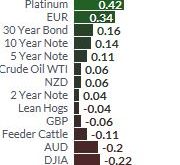

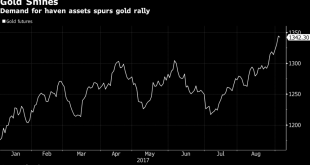

Read More »Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

– Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response– Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’– North Korea prepares for possible ICBM launch says S. Korea– U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump...

Read More »“Things Have Been Going Up For Too Long” – Goldman CEO

– “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch– Bubbles are everywhere including London property– $14 trillion of monetary stimulus has pushed investors to take more risks– We are now in a new era of bigger booms and bigger busts – BAML– “Seeing signs of bubbles in more and...

Read More »Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

– Physical gold is “the true currency of the last resort” – Goldman Sachs– “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” – Trump and Washington risk bigger driver of gold than risks such as North Korea– Recent events such as N. Korea only explain fraction of 2017 gold price rally – Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org