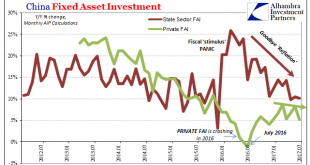

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »China: Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

Read More »Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its...

Read More »Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year. The move was considered by many if not most in the mainstream a prime example of Mario Draghi’s...

Read More »Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions. Therefore, if inflation behaves as it is supposed to after so many...

Read More »China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand. According to China’s National Bureau of Statistics, however, exports in June rose by...

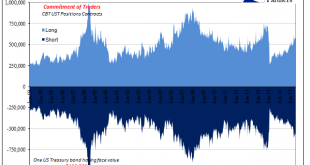

Read More »U.S. Treasuries: Not Really Wrong On Bonds

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

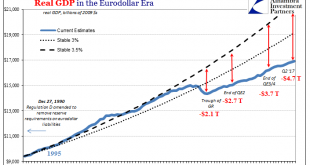

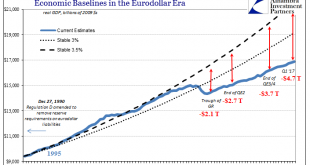

Read More »Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org