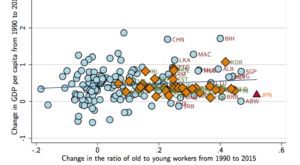

That’s what Daron Acemoglu and Pascual Restrepo document in an NBER working paper. Figure 2 [below] provides a glimpse of the relevant pattern by depicting the raw correlation between the change in GDP per capita between 1990 and 2015 and the change in the ratio of the population above 50 to the population between the ages of 20 and 49. … even when we control for initial GDP per capita, initial demographic composition and differential trends by region, there is no evidence of a negative...

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Die Volkswirtschaft 1–2 2017, December 21, 2016. HTML, PDF. Banning inside money creation would be unnecessary, insufficient, not enforceable, and besides the point. The way forward is to grant everyone access to central bank reserves and let investors choose between reserves and deposits.

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »“Wer hat Angst vor Blockchain? (Who’s Afraid of the Blockchain?),” NZZ, 2016

NZZ, November 29, 2016. HTML, PDF. Central banks are increasingly interested in employing blockchain technologies, and they should be. The blockchain threatens the intermediation business. Central banks encounter the blockchain in the form of new krypto currencies, and as the technology underlying new clearing and settlement systems. Krypto currencies bear the risk of “dollarization,” but in the major currency areas this risk is still small. New clearing and settlement systems benefit...

Read More »“Bitcoin May Have Implications for Monetary Policy,” LSE Business Review, 2016

The LSE Business Review (apparently) has published my VoxEU article.

Read More »“Fehldiagnose Secular Stagnation (Secular Stagnation Skepticism),” FuW, 2016

Finanz und Wirtschaft, November 23, 2016. PDF. The diagnosis is far from clear. Nor is the therapy.

Read More »“Blockchain, Cryptocurrencies, and Central Banks: Opportunity or Threat?,” World Economic Forum, 2016

The Word Economic Forum (apparently) has published my VoxEU article.

Read More »America: Many Open Questions

US voters have abandoned political correctness. Have they also abandoned decency? They have clearly voted for “change.” Eight years ago, they did the same. They have voted against competence according to common standards. Maybe because they perceived competence to be correlated with “no change.” Maybe because they viewed competence as a weakness. Picking non-competent leaders can pay off in specific bargaining situations. In general, it is unlikely to pay off in the longer term. Race was...

Read More »“Central Banking and Bitcoin: Not yet a Threat,” VoxEU, 2016

VoxEU, October 19, 2016. HTML. Central banks are increasingly interested in employing blockchain technologies. The blockchain threatens the intermediation business. Central banks encounter the blockchain in the form of new krypto currencies, and as the technology underlying new clearing and settlement systems. Krypto currencies bear the risk of “dollarization,” but in the major currency areas this risk is still small. New clearing and settlement systems benefit from central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org