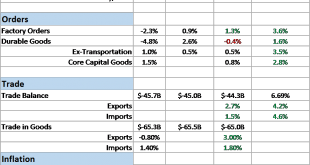

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

Read More »Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

Looming Currency and Liquidity Problems The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant. Our comments below...

Read More »How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar. While known to the investing public for years, the Bank of International Settlements (BIS) recently acknowledge that the real risk-off / risk-on metric in global markets is the dollar and...

Read More »Incrementum Advisory Board Meeting Q3 2016

Is Stagflation a Potential Threat? The Incrementum Fund held its quarterly advisory board meeting on October 3 (the transcript can be downloaded below). Our regular participants – the two fund managers Ronald Stoeferle and Mark Valek, advisory board members Jim Rickards, Frank Shostak and yours truly – were joined by special guest Grant Williams this time. Many of our readers probably know Grant; he is the author of...

Read More »Crude Oil Has Entered a Seasonal Downtrend

Erroneous Expectations Many market observers are probably expecting crude oil prices to enter a seasonal uptrend due the beginning heating season. After all, the heating season in the Northern hemisphere means that energy consumption will rise. The effect of the heating season on demand is however offset by other factors, such as the use of alternative energy sources and fixed prices agreements made in advance. The...

Read More »Great Graphic: CRB Index Revisited

Summary: Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods’ prices (think services). Bond yields are rising. The break-even rates, which compare conventional yields to the inflation-linked securities are also rising. These developments, which we do not think can be attributed to central bank...

Read More »“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under...

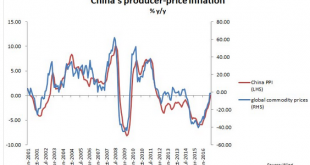

Read More »Great Graphic: China’s PPI and Commodities

Summary: China’s PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China’s PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside. China reported its first increase in producer prices in four years earlier today. As one might suspect, producer prices are often driven by commodity...

Read More »Gold Trends: The Myth of Leverage

Mining Stocks, Gold Prices and Commodity Price Trends Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much...

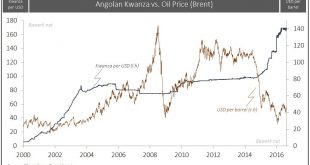

Read More »The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org