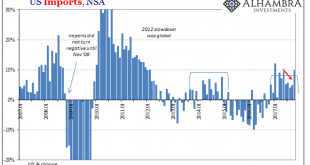

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year. US Imports, Jan 2007 - 2017 - Click to enlarge In both monthly cases, however, the almost normal rates of increase which would have at least suggested moving closer to a...

Read More »FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.21% to 1.1679 CHF. EUR/CHF and USD/CHF, December 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week’s EU summit. To be sure, “sufficient...

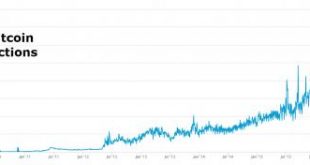

Read More »What Gives Cryptocurrencies Their Value

The value of cryptocurrencies like bitcoin, just like any other kind of money, comes fundamentally from what you can do with it. As a follow up to What Backs Bitcoin, I want to dig into that value. The idea, which comes from Austrian economist Carl Menger, is that just as a shovel’s value comes from its ability to dig, a currency’s value comes from its ability to help you do two things: transactions and savings. Think...

Read More »China bedroht die Globalisierung

Meister der Freihandels-Tricksereien: Niemand verletzt die WTO-Regeln so schamlos wie China (im Bild: Shanghai). Foto: Getty Images Chinas eigenwillige Rolle in der Weltwirtschaft wird zunehmend zum Problem. Wie kürzlich bekannt wurde, ist die chinesische HNA Group bei der Übernahme von Gate Gourmet unter den Verdacht geraten, falsche Angaben gemacht zu haben. Beim Kauf von Syngenta durch Chemchina sind Fragen zur Finanzierung aufgetaucht (Quelle). Und in Osteuropa möchte China...

Read More »Nachhaltige Fonds knacken 100 Milliarden-Franken-Grenze

Bild: Pixabay Nachhaltige Investmentfonds sind in der Schweiz in den letzten zehn Jahren doppelt so schnell gewachsen wie der Gesamtmarkt. Vor allem bei institutionellen Anlegern, aber auch bei jüngeren, gebildeten und meist weiblichen Privatanlegern werden sie beliebter. Das zeigt eine Studie des Instituts für Finanzdienstleistungen Zug IFZ der Hochschule Luzern. Nachhaltige Anlagen waren früher...

Read More »Zurich setzt sich neue Nachhaltigkeits-Ziele

Bild: Zurich Insurance Group Die Zurich Insurance Group will ihr Engagement im Bereich nachhaltiges Investieren ausbauen und führt Impact-Ziele ein. Mitte des Jahres hatte die Zurich Insurance Group (Zurich) bekannt gegeben, ihr langjähriges Ziel – 2 Milliarden US-Dollar in grüne Anleihen zu investieren – erreicht zu haben. Diese Anlagen sind Bestandteil des Impact-Investment-Portfolios. Mit der...

Read More »Das Drehbuch von Chinas Erfolg

Alibaba folgte dem Prinzip von Friedrich List: Der Konzern wurde gross, ohne von Amazon zerstört zu werden. (Foto: EPA/Jeff Lee) Kennen Sie Tencent? Das ist ein chinesischer Internetkonzern, 1998 gegründet und in Shenzhen beheimatet. Tencent ist das Mutterhaus von Wechat, der führenden Chat-Plattform in China (eine Art Whatsapp, aber deutlich besser), eine Grossmacht im Geschäft mit webbasierten Games und Anbieter der mobilen Bezahllösung Tenpay, die von Hunderten Millionen Konsumenten...

Read More »For The First Time Ever, The “1%” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

Read More »Falcon-Banker wird CEO von Bitcoin Suisse

Bild: Pixabay Arthur Vayloyan ist neuer CEO des grössten Schweizer Brokers und Verwalters für Krypto-Assets. Arthur Vayloyan ist neu Co-CEO von Bitcoin Suisse. Im November 2017 trat er nach mehr als 25-jähriger Bankkarriere in das Unternehmen ein. Schon zuvor war er von Kryptowährungen überzeugt. Zuletzt war Vayloyan Global Head Products & Services und Mitglied des Executive Board der Falcon...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org