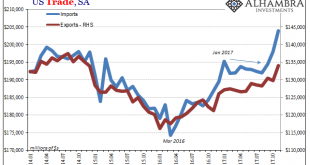

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007. US Trade Balance, Jan 2014 - 2018(see more posts on U.S. Trade Balance, ) - Click to...

Read More »Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

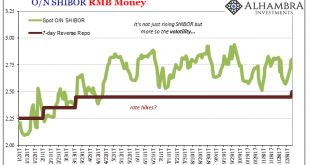

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

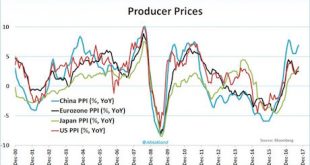

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »FX Daily, December 18: Trade Tensions with China Set to Escalate

Swiss Franc The Euro has risen by 0.10% to 1.165 CHF. EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure...

Read More »China Exports and Industrial Production: Revisiting Once More The True Worst Case

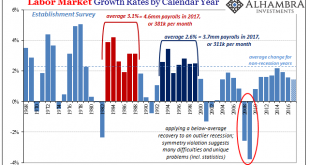

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »Three Years Ago QE, Last Year It Was China, Now It’s Taxes

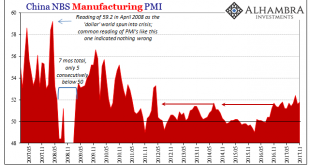

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month. China Manufacturing...

Read More »49 Countries Have Violated Sanctions On North Korea

A new report from the Institute for Science and International Security has found that 49 countries violated sanctions on North Korea to varying degrees between March 2014 and September 2017. You will find more statistics at Statista 13 governments including Cuba, Egypt, Iran and Syria were involved in military violations, which as Statista’s Martin Armstrong notes, includes either receiving military training from North...

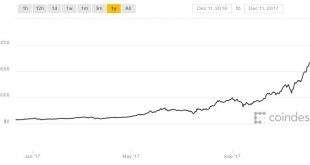

Read More »Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

Bitcoin - Plan Your Exit Strategy Now - Maybe With Gold Made money in bitcoin? Well done. Don’t wait until the stampede starts. Here’s what you must do now. by Dominic Frisby in Money Week So there I was on Sunday afternoon, doing what it is one does on a Sunday – very little in my case – and a notification comes up on my phone: “Bitcoin rises over 10% to $11,800”. Bitcoin in USD (1 Year). Source: CoinDesk On a Sunday. When every other market is closed. It’s bad enough that bitcoin is making...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org