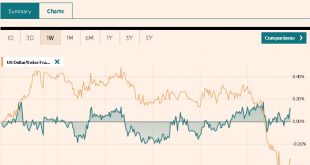

Swiss Franc The Euro has risen by 0.05% to 1.0893 EUR/CHF and USD/CHF, December 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: Equities are finishing the holiday-shortened week on a firm note, encouraged by strong holiday internet sales in the US. Most markets in the Asia Pacific region advanced except China and Thailand, while Japanese markets were mixed after weak industrial output and retail sales. The MSCI Asia...

Read More »China Data: Something New, or Just The Latest Scheduled Acceleration?

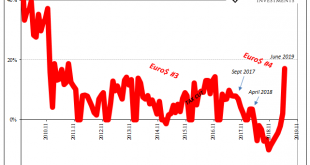

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day. A new set of relatively strict pollution controls was added in the second half of this year. As is...

Read More »FX Daily, December 16: China Data Surprises to the Upside while Europe’s Manufacturing PMI Disappoints

Swiss Franc The Euro has risen by 0.05% to 1.095 EUR/CHF and USD/CHF, December 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite better than expected Chinese data, and last week’s investor-friendly developments, Asia Pacific equities were mixed. Australia led the advancing bourses with a 1.6% gain, its largest for the year despite the government revising down growth and wages. China, Taiwan, and Indian...

Read More »Chinas Aufstieg zur digitalen Macht

Die Folgen des Handelsstreits sind weniger dramatisch als angenommen. Doch dieser führt zur zunehmenden Zweiteilung der Welt. We Chat statt Whatsapp, Huawei statt iPhone: China setzt die Politik der digitalen Autarkie fort. Foto: Reuters «Präsident Trumps Strafzölle gegen die wichtigsten Handelspartner haben einen Konflikt mit unabsehbaren Folgen ausgelöst.» Diese Zeile las man vor kurzem in der NZZ. Allgemein dient der Handelsstreit zwischen den USA und China heute...

Read More »If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

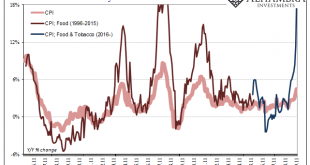

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

Read More »FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

Swiss Franc The Euro has risen by 0.05% to 1.0949 EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for...

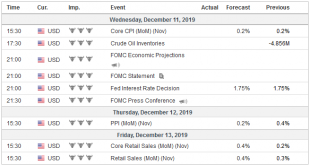

Read More »FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year. The UK and China have their monthly data dumps—a concentration of high-frequency data. The US reports both CPI...

Read More »More Signals Of The Downturn, Globally Synchronized

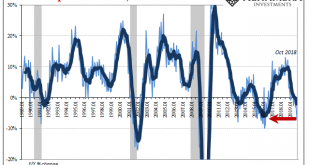

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »FX Daily, December 4: Hope Springs Eternal

Swiss Franc The Euro has risen by 0.19% to 1.0957 . FX Rates Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite...

Read More »China widerlegt Montesquieu

Die Einbindung Chinas in den Welthandel hat die Demokratie im Land kaum gefördert. Das zeigt, dass Handel Gesellschaften nicht besänftigt. Türken und Uiguren protestieren in Istanbul gegen die Internierung von mehr als einer Million Uiguren in der chinesischen Provinz Xinjiang. Foto: Keystone Handel schafft offenere Gesellschaften, Demokratie und wirtschaftlichen Fortschritt: Solche Argumente gibt es bereits seit Jahrhunderten. Schon der Aufklärungsphilosoph...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org