Swiss Franc The Euro has fallen by 0.27% to 1.0704 EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China’s week-long Lunar New Year celebration when markets will be closed, which may...

Read More »FX Daily, January 21: New Respiratory Illness Saps Risk-Taking Appetites

Swiss Franc The Euro has risen by 0.05% to 1.0743 EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spread of a new respiratory illness in China has spurred a wave of profit-taking in equities and risk assets more generally. All of the markets in the Asia Pacific region tumbled, with Hong Kong hit the hardest (-2.8%) after posting a key reversal yesterday. The sell-off continued...

Read More »China Enters 2020 Still (Intent On) Managing Its Decline

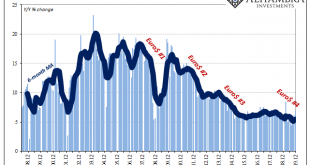

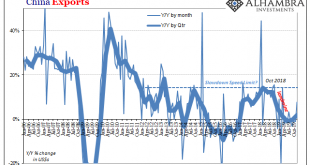

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it. Rather than suggest the global economy is picking up, or ended last year in a “good...

Read More »FX Daily, January 20: Stocks Stall while the Dollar Remains Bid

Swiss Franc The Euro has risen by 0.05% to 1.0737 EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week is off to a quiet start as the US celebrates Martin Luther King’s birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a...

Read More »FX Daily, January 17: China and the UK Surprise in Opposite Directions

Swiss Franc The Euro has risen by 0.06% to 1.0745 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe’s Dow Jones Stoxx 600 is at new record highs and appears set to...

Read More »FX Daily, January 16: Markets Look for New Cues with US-China Trade Pact Signed

Swiss Franc The Euro has risen by 0.04% to 1.0749 EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are calm today as investors await fresh trading incentives. New record highs in the US equity indices gave Asia Pacific stocks a lift, though China and Taiwan were notable exceptions. Europe’s Dow Jones Stoxx 600 is firm new record highs set last week. US...

Read More »Clarida Picks Up Some Data

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a...

Read More »FX Daily, January 15: Phase 1 Trade Deal Shifts Terrain of US-China Rivalry

Swiss Franc The Euro has fallen by 0.18% to 1.0744 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that US tariffs on China will remain until through at least the November US election and continued US attempts to stymie China (e.g., more curbs on Huawei under consideration and stepped up efforts to force it to cut subsidies to business) have taken some momentum from the push...

Read More »FX Daily, January 14: China was a Currency Manipulator for a Few Months

Swiss Franc The Euro has fallen by 0.37% to 1.0767 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The leaked US decision to lift the currency manipulator designation on China was the latest fodder fueling the new record highs in the S&P 500. The risk-taking appetite helped extend the rally in the MSCI Asia Pacific Index for the fourth consecutive session. Europe’s Dow Jones...

Read More »FX Daily, January 13: Dismal Data Undercuts Sterling and Boosts Chances of a Rate Cut

Swiss Franc The Euro has fallen by 0.08% to 1.080 EUR/CHF and USD/CHF, January 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org