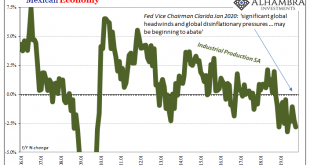

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts). Mexico is, as I’ve been writing this week, the presumed...

Read More »FX Daily, January 9: Animal Spirits Roar Back

Swiss Franc The Euro has fallen by 0.07% to 1.0804 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei’s 2% advance leading the way. More broadly, the markets in Taiwan,...

Read More »The Real Trade Dilemma

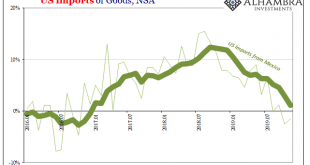

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are. They may be winners because of it but somehow they all still end up in the losing column. Late...

Read More »FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Swiss Franc The Euro has fallen by 0.10% to 1.0827 EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a...

Read More »Ein Jahrzehnt der Zeitbomben

Wo in den 2020er Jahren die grössten Risiken für die Weltwirtschaft lauern. China und die USA dürften in Zukunft öfter aneinandergeraten: Militärparade in Peking am 1. Oktober 2019. Foto: Kevin Frayer (Getty Images) Die Wirtschaftsprognosen für das neu begonnene Jahr sind zwar nicht berauschend, aber eine Rezession droht gemäss den Vorhersagen nicht. Und ein schwächeres Wachstum wirke sich kaum auf die Arbeitsmärkte aus. Mehr Anlass zur Sorge geben aber eine Reihe...

Read More »FX Daily, January 6: Markets Struggling to Stabilize to Start the New Week

Swiss Franc The Euro has fallen by 0.06% to 1.0851 EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have yet to stabilize amid heightened geopolitical tension. Even though the US stock market finished last week off its lows, the sell-off continued in the Asia Pacific region. Japan’s markets re-opened after an extended holiday, and the yen, at three-month...

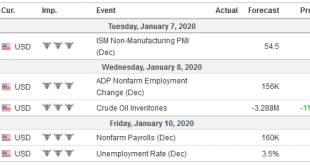

Read More »FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures. While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20...

Read More »FX Daily, January 02: Equities Start New Year with a Pop

Swiss Franc The Euro has fallen by 0.03% to 1.0845 EUR/CHF and USD/CHF, January 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities have begun New Year like, well, last year, with most Asia Pacific markets advancing, led by more than 1% gains in China, Hong Kong, and Thailand. Only South Korea and Indonesian markets fell. In Europe, the Dow Jones Stoxx 600 is up almost 1% in late morning turnover. US...

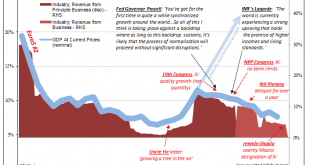

Read More »A Sour End To The 2010’s Doesn’t Have To Spoil The Entire 2020’s

It has been perhaps the most astonishing divergence in the first two decades of 21st century history. In late 2017, Western economic officials (mostly central bankers) were taking their victory laps. They took great pains to tell the world it was due to their profound wisdom, deep courage, and, most of all, determined patience, that they had been able to see their policies through to the light of day (no thanks to voters around the world). This set up the third...

Read More »The Turn

The year is winding down quietly, and the last week of 2019 is likely to be more of the same. The general mood of the market is quite different than a year ago. Then investors had marked down equities dramatically amid fears of what was perceived as a synchronized downturn. Now with additional monetary easing in the pipeline and renewed expansion of the Federal Reserve and European Central Bank’s balance sheets, risk appetites have been stoked. Previously, the notion...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org