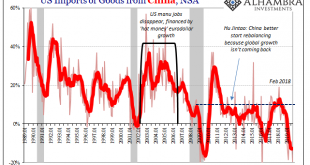

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018? I don’t mean to ask what his rationale was, more along the lines of, why 2018? Why...

Read More »FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.0987 EUR/CHF and USD/CHF, November 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week’s gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index...

Read More »FX Daily, November 5: Animal Spirits Remain Animated

Swiss Franc The Euro has risen by 0.05% to 1.0994 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August...

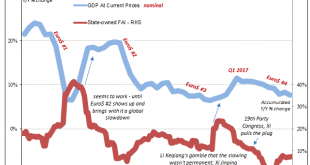

Read More »More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

Read More »FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Swiss Franc The Euro has risen by 0.24% to 1.1023 EUR/CHF and USD/CHF, November 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: An unexpected increase in China’s Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of...

Read More »FX Daily, October 31: No Good Deed Goes Unpunished

Swiss Franc The Euro has fallen by 0.32% to 1.0993 EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity and bond rally in North America yesterday carried over into today’s session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P...

Read More »FX Daily, October 29: Calm before the Storm

Swiss Franc The Euro has risen by 0.04% to 1.104 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The more prominent events this week still lie ahead, and the capital markets are trading accordingly. The rally that lifted the S&P 500 to new record highs yesterday carried over into Asia, where most equity markets rose, though China, Hong Kong, and South Korea were notable...

Read More »FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Swiss Franc The Euro has risen by 0.24% to 1.104 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe’s Dow Jones Stoxx 600 took a five-day advancing...

Read More »FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Swiss Franc The Euro has fallen by 0.02% to 1.1014 EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe’s Dow Jones Stoxx 600 is little...

Read More »Cool Video: China Still Needs to Provide more Stimulus

The IMF projects that China will expand by less than 6% in 2020, but unless China provides more stimulus, it may be difficult to achieve. This is not only my view but also the view of Helen Qiao, the chief economist for Greater China at Bank of America. I was on the Bloomberg set with Alix Steele and Ms. Qiao earlier today. The PBOC passed on an opportunity to cut rates this week when it set the new Loan Prime Rate. Qiao says there is still a window for fresh action...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org