My VoxEU column now also on finews and World News Monitor, September 17, 2019. Digital currencies involve tradeoffs. Libra resolves them less favorably than other projects, and less favorably than CBDC. When confronted with the choice between the status quo and a new financial architecture with CBDC, most central banks have responded cautiously. But Libra or its next best replica will take this choice off the table – the status quo ceases to be an option. The new choice for monetary...

Read More »“Libra Paves the Way for Central Bank Digital Currency,” VoxEU, 2019

VoxEU, September 12, 2019. HTML. Digital currencies involve tradeoffs. Libra resolves them less favorably than other projects, and less favorably than CBDC. When confronted with the choice between the status quo and a new financial architecture with CBDC, most central banks have responded cautiously. But Libra or its next best replica will take this choice off the table – the status quo ceases to be an option. The new choice for monetary authorities and regulators will be one between...

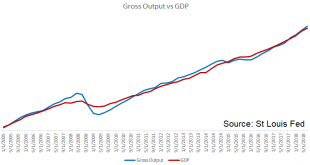

Read More »GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth. Borrowing to Consume Today,...

Read More »CBDC and Financial Stability

Central Banking reports about the new working paper by Markus Brunnermeier and myself.

Read More »“Public versus Private Digital Money: Macroeconomic (Ir)relevance,” VoxEU, 2019

VoxEU, March 20, 2019, with Markus Brunnermeier. HTML. Both proponents and opponents have suggested that CBDC would fundamentally change the macroeconomy, either for the better or the worse. We question this paradigm. We derive an equivalence result according to which the introduction of CBDC need not alter the allocation nor the price system. And we argue that key concerns put forward in discussions about CBDC are misplaced. See also our VoxEU book chapter and my paper from last year.

Read More »“Public versus Private Digital Money: Macroeconomic (Ir)relevance,” VoxEU, 2019

VoxEU, March 20, 2019, with Markus Brunnermeier. HTML. Both proponents and opponents have suggested that CBDC would fundamentally change the macroeconomy, either for the better or the worse. We question this paradigm. We derive an equivalence result according to which the introduction of CBDC need not alter the allocation nor the price system. And we argue that key concerns put forward in discussions about CBDC are misplaced. See also our VoxEU book chapter and my paper from last year.

Read More »“Reserves For All? Central Bank Digital Currency, Deposits, and their (Non)-Equivalence,” IJCB

Accepted for publication in the International Journal of Central Banking. PDF. This paper offers a macroeconomic perspective on the “Reserves for All” (RFA) proposal to let the general public hold electronic central bank money and transact with it. I propose an equivalence result according to which a marginal substitution of outside money (e.g., RFA) for inside money (e.g., deposits) does not affect macroeconomic outcomes. I identify key conditions for equivalence and argue that these...

Read More »“Reserves For All? Central Bank Digital Currency, Deposits, and their (Non)-Equivalence,” IJCB

Accepted for publication in the International Journal of Central Banking. PDF. This paper offers a macroeconomic perspective on the “Reserves for All” (RFA) proposal to let the general public hold electronic central bank money and transact with it. I propose an equivalence result according to which a marginal substitution of outside money (e.g., RFA) for inside money (e.g., deposits) does not affect macroeconomic outcomes. I identify key conditions for equivalence and argue that these...

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

Read More »Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower. Some would go so...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org