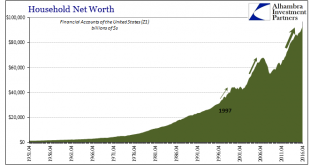

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated...

Read More »No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression. Weakness might be more easily believed as some overseas problem, leading to only ideas of decoupling or the US as the “cleanest...

Read More »Bi-Weekly Economic Review

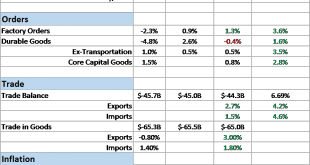

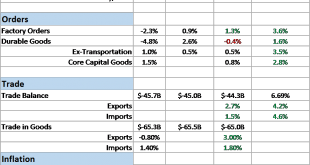

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

Read More »Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Update December 2016: Italians rejected the referendum that seeks to increase power of the prime minister and reduce power of the two chambers parliament. Prime minister Renzi has promised to resign. This opens the door for new elections, in which the anti-euro parties Movimento 5 stelle (5 star movement) and Lega Nord (Northern League) may strengthen. ————————————————————————————— Update December 2013: Bear in mind...

Read More »FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

Comment on GBP and CHF by Matt Vassallo My articles About meMy booksFollow on: Swiss Franc EUR/CHF - Euro Swiss Franc, November 10(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald...

Read More »Great Graphic: Stocks and Bonds

Summary: The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015. As market participants, we are sensitive to changing inter-market relationships. This Great Graphic, from Bloomberg shows the correlation...

Read More »FX Weekly Preview: Capital Markets in the Week Ahead

Summary: Global bonds and global stocks ended last week on a weak note and this will likely carry into this week’s activity. The Bank of England meets, but the data may be more important. Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week. The week ahead will likely be shaped by a combination of...

Read More »FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

[unable to retrieve full-text content]The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org