Summary: DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound. European banks may not be the main driver of the investment climate, but their challenges are not resolved. Investors have focused on two country’s banks recently. Germany’s Deutsche Bank and Italian banks more generally. This Great...

Read More »Investing in Brazil: Sectors on the Mend

Will the recent upheaval in Brazil’s political leadership lead to a stronger economy? Investors certainly think so. Fueled by anticipation of embattled president Dilma Rousseff’s impeachment and economic reforms by her replacement, Michael Temer, the Bovespa has jumped more than 50 percent since late January. In the week after Rousseff’s official ouster on August 31, the index rose a full 4 percent, and Brazilian consumer confidence reached its highest level since January...

Read More »Scenarios for Italian banks’ bad loans

Our model suggests that the Italian government’s strategy for the bad debt problems of the country's banks only will only be credible if economic growth returns Changes in banks’ Non-Performing Loans (NPLs) depend crucially on economic performance, including GDP growth and employment. Put simply, the Italian government’s strategy, or hope, is that even a modest economic recovery leads to a sustained, albeit gradual decline in NPLs and that systemic bank bailouts can be avoided. Moreover,...

Read More »European Banks Bad Loans and Coverage

Summary: European banks are worrisome. EBA’s stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed. The health of European banks has reemerged as an important market factor this year. The IMF warned that the greatest risk to global financial stability stems from three European banks. Branches of two European banks failed the Federal...

Read More »European Bank Stress Test: Preview

Summary European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries’ banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules. The results of the latest stress tests on European banks are expected to be released at 10:00 am CET (5:00 am ET). The...

Read More »European Court of Justice Ruling Weighs on Italian Banks

Summary: ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event. The European Court of Justice upheld the principle of making creditors bear the burden for investment in banks that sour before government funds can be used. Italian banks are particularly...

Read More »New Wrinkle in European Bail-In Efforts

Summary: European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness. After the 2007-2008 bank recapitalization by governments, which means taxpayers’ money, Europe changed the rules. The...

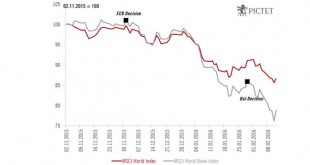

Read More »The dark side of negative interest rates

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ...

Read More »What to Expect from a Brexit Vote

The threat of secession has dogged both European governments and the region as a whole for the last four years. Greece has come perilously close to leaving the euro a number of times since 2012, Scottish voters rejected a proposition to leave the United Kingdom in 2014, and 80 percent of those who voted in Spain’s Catalonia region said they would like to be an independent state in a non-binding poll the same year. (Catalonian separatists plan another push for independence over the next 18...

Read More »What’s the Future of Lending?

Need a loan? You can always go to a bank. Or you can try to borrow from your peers. Increasingly popular “peer-to-peer lending portals” allow borrowers and lenders to connect directly through online marketplaces, threatening to disintermediate traditional financial institutions in the process. But how do peer-to-peer sites assess the risk involved in the loans they make? What role will regulation play in their future? Will institutional investors get on board? Industry experts discussed these...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org