Macroview Further action may come once the BOJ has fully reviewed the effectiveness of existing policies, but for now the focus is turning to the latest fiscal package On 29 July, the Bank of Japan (BOJ) announced that it would keep the current pace of monetary base expansion unchanged at JPY80 trillion per year and left the policy interest rate unchanged at -0.1%.Although the central bank did announce a doubling of its purchases of exchange-traded funds (ETFs) and an expansion of its dollar-lending programme, the BOJ failed to meet market expectations of easing against a backdrop of weak economic momentum and sliding market confidence. In our view, the relatively conservative stance adopted by the BoJ on 29 July is recognition of the limit of what monetary policies alone can achieve.While the scope for further expansion of the BoJ’s bond purchase programme is limited, we cannot rule out the possibility of future rate cuts after central bank officials have fully reviewed the effectiveness of existing monetary measures.In the near term, we believe the market’s focus will shift towards the details of the new JPY28 trillion fiscal stimulus package announced on 27 July by Prime Minister Shinzo Abe.

Topics:

Dong Chen considers the following as important: Abenomics, Bank of Japan, Japan fiscal package, Japanese monetary policy, Macroview

This could be interesting, too:

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Higher Yields Help Extend the Dollar’s Gains

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

Further action may come once the BOJ has fully reviewed the effectiveness of existing policies, but for now the focus is turning to the latest fiscal package

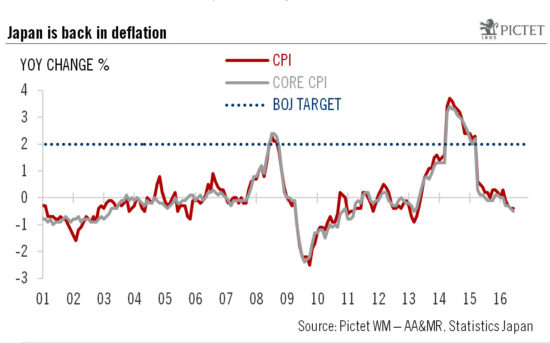

On 29 July, the Bank of Japan (BOJ) announced that it would keep the current pace of monetary base expansion unchanged at JPY80 trillion per year and left the policy interest rate unchanged at -0.1%.

Although the central bank did announce a doubling of its purchases of exchange-traded funds (ETFs) and an expansion of its dollar-lending programme, the BOJ failed to meet market expectations of easing against a backdrop of weak economic momentum and sliding market confidence. In our view, the relatively conservative stance adopted by the BoJ on 29 July is recognition of the limit of what monetary policies alone can achieve.

While the scope for further expansion of the BoJ’s bond purchase programme is limited, we cannot rule out the possibility of future rate cuts after central bank officials have fully reviewed the effectiveness of existing monetary measures.

In the near term, we believe the market’s focus will shift towards the details of the new JPY28 trillion fiscal stimulus package announced on 27 July by Prime Minister Shinzo Abe. While the headline figure is significantly higher than the JPY20 trillion that was being expected in some quarters, we believe the actual level of spending in the current fiscal year (which ends on 31 March 2017) could be much smaller. According to Mr. Abe, out of the JPY28 trillion, JPY13 trillion is budgeted for “fiscal measures”, one half of which could involve fresh government spending while the other half could consist of funds made available to the private sector at a low cost. But the JPY6.5 trillion worth of public spending being tipped will not all be in the current fiscal year. While more details of the stimulus package won’t be available until next week, we don’t have overly high expectations of its impact on the Japanese economy in the near term.

In our view, the ultimate solution to Japan’s economic problems lies in structural reforms. More flexibility in the labour market and deregulation that encourages innovation are greatly needed to combat Japan’s increasingly severe demographic challenges. Those reforms are the so-called ‘third arrow’ of Abenomics. But so far it hasn’t been fired.