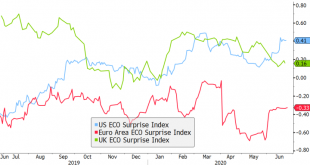

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit. This comes as markets are grappling with still-rising virus numbers in the US and resurgent numbers in many other countries that call into question the durability of the economic recovery....

Read More »Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday RBNZ is considering an extension...

Read More »EM Preview for the Week Ahead

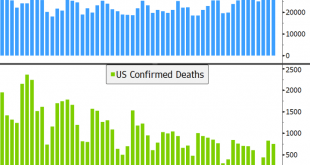

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates. AMERICAS Brazil reports May retail sales Wednesday. Sales are expected to contract -13.5% y/y vs. -16.8% in April. June IPCA inflation will be reported Friday, which is...

Read More »Dollar Soft Ahead of Jobs Report

Re-shutdowns continue to spread across the US; the dollar has come under pressure again Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill The UK offered a home to nearly 3 mln Hong Kong citizens; Russia President Putin will...

Read More »Dollar Begins the Week Under Pressure Again

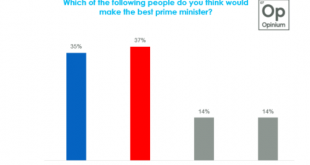

The virus news stream remains negative; pressure on the dollar has resumed The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections French and German leaders meet to discuss the planned EU pandemic rescue package; UK and EU begin their “intensified timetable” for Brexit...

Read More »EM Preview for the Week Ahead

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US jobs number Thursday....

Read More »Recent Trade Developments Suggest Some Caution Ahead Warranted

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities. RECENT DEVELOPMENTS Back in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic”...

Read More »Dollar Firm as Risk-Off Sentiment Persists

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out Fitch cut Canada’s rating by a notch to AA+ with stable outlook; Mexico is expected to cut rates 50 bp to 5.0%;...

Read More »Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico...

Read More »Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week Eurozone reports preliminary June PMI readings Tuesday; ECB releases its account of the June meeting Thursday All quiet on the Brexit front; UK reports preliminary June PMI readings Tuesday Japan...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org