The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB. WHAT ELSE CAN THE SNB DO? The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates...

Read More »Dollar Suffers as Stimulus Efforts Boost Market Sentiment

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight Comments from UK and EU officials have sparked optimism about Brexit talks; UK...

Read More »EM Preview for the Week Ahead

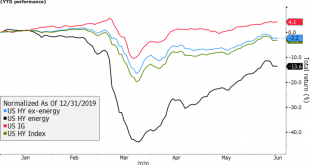

EM and other risk assets stabilized to end the week after Thursday’s selloff, but remain vulnerable. The risks ahead are the same as before, which include a second wave of infections as well as a longer and shallower than expected recovery in global growth. The Fed’s message of low rates as far as the eye can see was balanced by Powell’s grim outlook for unemployment. The liquidity story should remain positive for EM, with the BOE expected to increase its QE this...

Read More »Dollar Firm as Risk-Off Sentiment Intensifies After FOMC Decision

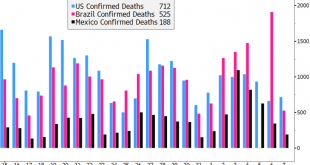

Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported Peru is expected to keep rates steady at 0.25%; Brazil inflation data supports a 75 bp cut next week The...

Read More »Dollar Firm as Risk-Off Sentiment Takes Hold

Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus Some minor US data will be seen today; Mexico reports May CPI Germany reported weak April trade and current account data; there were two important developments in Turkey today Japan reported...

Read More »Dollar Broadly Weaker Ahead of FOMC Decision

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m Japan reported weak May PPI and April core machine orders; Australia reported mixed sentiment indicators;...

Read More »Dollar Stabilizes as the New Week Begins

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer The US bond market selloff continues; for now, the weak dollar trend is hard to fight The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics German IP came in a bit worse than expected at -17.9% m/m; the OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices Japan Q1 GDP revised higher on...

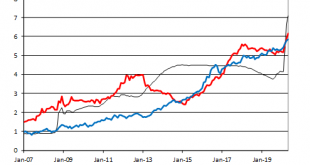

Read More »Our Latest Thoughts on the Dollar

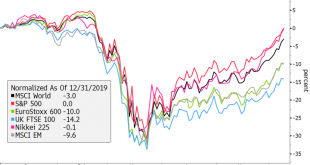

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows. Dollar Index, 2015-2020 - Click to enlarge RECENT DEVELOPMENTS There is a growing debate as to the root causes of recent dollar weakness. Is it the burgeoning national debt? The poor US...

Read More »Dollar Firm as Risk-On Sentiment Ebbs Ahead of ECB Decision

Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening Australia reported...

Read More »Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org