Profitable bond trading opportunities arise when your expectations about Fed policy differ from those of the market. Therefore, with the Fed seemingly embarking on a series of interest rate cuts, it behooves us to appreciate how many interest rate cuts the Fed Funds futures market expects and over what period. Equally important, Fed Funds futures help us assess the market’s economic growth and inflation expectations. Currently, Fed Funds futures imply the Fed...

Read More »UBI – Tried, Tested And Failed As Expected

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be. What Is A Universal Basic Income (UBI) To understand why the theory of universal basic income (UBI) is heavily flawed, we need to understand what UBI...

Read More »What a Financial Advisor? Consider these Seven Concepts.

So, you need a financial advisor, but do you truly understand the full extent of the benefits? Consider these Magnificent Seven Concepts: Concept One: Financial Advisors are NOT Portfolio Managers. Most consumers believe that financial advisors are primarily investment selectors and asset managers. While these duties are valid, they are not at the top of an advisor’s list or priorities. Many financial advisors outsource these duties to third-party experts...

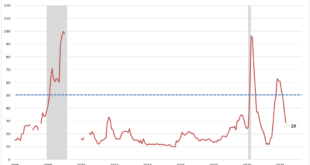

Read More »Confidence Is The Underappreciated Economic Engine

Ask economists how they forecast economic activity. It’s likely they will mention productivity, demographics, debt, the Fed, interest rates, and a litany of other elements. Economic confidence is probably not at the top of the list for most economists. It is tricky to gauge as it can be inconsistent. However, confidence can sometimes change quickly and often with significant economic impacts. Look at the two pictures below. Can you spot a difference between...

Read More »Yen Carry Trade Blows Up Sparking Global Sell-Off

On Monday morning, investors woke up to plunging stock markets as the “Yen Carry Trade” blew up. While media headlines suggested the sell-off was due to fears of a recession, slowing employment growth, or fears over Israel and Iran, such is not the case. As previously noted, headline events like the economy, employment, or geopolitical conflict are quickly evaluated and hedged by market participants. However, as we saw on Monday, what sparks a global sell-off is...

Read More »The Bull Market – Could It Just Be Getting Started?

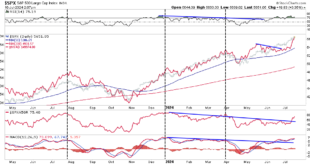

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls. We discussed that issue in detail in “Bad Breadth Keeps Getting Worse,”...

Read More »Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.” Over the past few months, we have seen the same term, irrational exuberance, used to describe the current state of the stock market. To gain perspective on the future, let’s compare the market environment that prompted...

Read More »Deviations From Long-Term Growth Trends Back To Extremes

In 2022, we discussed the market’s deviations from long-term growth trends. That discussion centered on Jeremy Grantham’s commentary about market bubbles. To wit: “All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five...

Read More »Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit: “It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability...

Read More »Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org