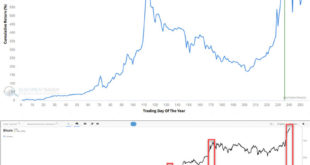

Since the election, Bitcoin has risen nearly 50%. While Bitcoin investors are licking their chops, believing the magnificent rally will continue, they need to realize that Bitcoin is entering a period of pronounced seasonal volatility. The graph below from Sentimentrader shows that the recent performance has tracked the typical performance for the time of year. However, as they highlight with the green line, the recent gains may fade, and volatility in Bitcoin may...

Read More »Trump Tariffs Are Inflationary Claim The Experts

Mark Cuban Says Trump's Tariff Proposals Will Ramp Up Prices- Business Insider Fed's Kashkari Says Trump Tariffs Could Reheat Inflation If They Provoke Global Trade War- CNBC Blanket Tariffs Would Be Incredibly Inflationary, Says Strategist- CNBC Treasury Secretary Janet Yellen Warns "Sweeping Untargeted Tariffs" Would Reaccelerate Inflation- CBS News Trump Tariffs Expected To Spike Inflation, Interest Rates- Business Insider The headlines regarding...

Read More »Walmart Shares: Great Fundamentals But At A Frothy Price

Walmart's (WMT) shares opened higher as its earnings report surpassed expectations. EPS and revenues beat expectations. Moreover, the company increased its sales guidance for next year by a full percent. As its latest earnings report reminded us, Walmart is doing very well financially. Furthermore, its share price has surged, reflecting the company's health. While the price of Walmart shares should increase with its fundamentals, we must ask if the stock...

Read More »Gold Miners Enter The Bears Den

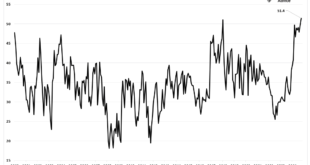

Many investors consider a decline of 20% or more to be a bear market. We can debate the merit of the random 20% figure, but according to that definition, gold miners, down 25% from its peak on October 22, are in a bear market. We have noted numerous times in the last month or so that gold and gold miners were getting very overbought based on their technicals. Furthermore, our recent article - Why Is Gold Surging? - highlights how the price of gold is diverging from...

Read More »Yardeni And The Long History Of Prediction Problems

Following President Trump's re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets. Unsurprisingly, the rush by perma-bulls to make long-term predictions is remarkable. For example, Economist Ed Yardeni believes this upward momentum will continue and has revised his long-term forecast, projecting that the S&P 500 will reach 10,000 by 2029. His forecast reflects a mix of factors...

Read More »5X5 Inflation Expectations: A New Benchmark To Follow

At the last FOMC meeting, Jerome Powell was asked if they were concerned that inflation expectations are “de-anchoring, or put another way, are anchoring at a slightly higher level?” His answer specifically referenced the 5x5 forward inflation expected rate. He could have used many data points to answer the question. However, the fact that he specifically mentioned the 5x5 rate gives us an inflation expectations benchmark to better gauge how the Fed will manage...

Read More »“Trump Trade” Sends Investors Into Overdrive

Inside This Week's Bull Bear Report "Trump Trade" Sends Investors Into Overdrive How We Are Trading It Research Report -Paul Tudor Jones - I Won't Own Bonds Youtube - Before The Bell Market Statistics Stock Screens Portfolio Trades This Week A Pause That Refreshes? Last week, we discussed that with the election over and the Federal Reserve cutting interest rates, many market headwinds were put behind us. To wit; "As a result, the market surged...

Read More »The MACD: A Guide To This Powerful Momentum Gauge

When we discuss technical analysis in our articles and podcasts, we often examine the moving average convergence divergence indicator, better known as the MACD, or colloquially the Mac D. The MACD is one of our favored technical indicators to help forecast prices and manage risk. Accordingly, let's learn more about the MACD to see how it detects trends, potential trend changes, and assesses momentum. It's important to stress we use many technical and fundamental...

Read More »Seeking Beta

While the "Trump rally" appears to have just begun, one of its initial hallmarks is that investors want beta. Beta is a measure of the volatility of a stock versus the broader market, most often the S&P 500. For instance, a stock with a beta of 1.50 implies that based on prior trading, investors should expect the stock to be 1.50% more volatile than the S&P 500. Investors seeking beta must assume the market will be heading higher in the short term; thus,...

Read More »Crypto Soars

On the campaign trail, Donald Trump favored the crypto industry, including appointing "crypto-friendly" regulators. Moreover, one of the plans he mentioned several times was the creation of a federal strategic reserve of crypto assets. Trump's decisive victory, along with the Republican sweep of Congress, makes it even more likely the crypto industry and related cryptocurrencies will benefit from a Trump presidency. Accordingly, in the aftermath of the election,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org