I just finished reading Free by 40 in Switzerland, a book about financial independence, in Switzerland, by fellow blogger Mr. Mustachian Post, alias Marc Pittet. Mr. MP was kind enough to send me a version that I could review before the release date. So I can have this review ready now that the book is available! Free by 40 in Switzerland will go over how to retire by the age of 40 in Switzerland. It covers how to reduce your expenses, increase your income, and...

Read More »The 4 Stages of Wealth

(Disclosure: Some of the links below may be affiliate links) During your financial life, you will go through several stages of wealth. Maybe you have already crossed several of them, or maybe you are at the first stage of wealth. Regardless of where you are, it is important to know what is ahead and prepare for your future stages of wealth. There are many things you can do to prepare your future financial stages. In this article, I will talk about the 4 main stages...

Read More »What is The Best Credit card in Switzerland for 2020?

(Disclosure: Some of the links below may be affiliate links) A credit card is a powerful personal finance tool. But it is only a good tool if used correctly. And unfortunately, many people are not using credit cards correctly. The first important thing is to choose a card with no annual fee. You should focus on that first. Contrary to what credit card companies want you to believe, it is often better to get a credit card with no fee and smaller cashback than an...

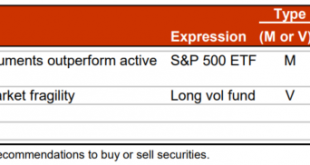

Read More »Seth Levine: How I Process Ideas Into Investments

How I Process Ideas Into Investments Investing is incredibly hard. Mapping observations to security price movements are complex. Often, the relationships governing these moves are unknown. Yet, this is the investor’s task. I’ve used this blog as a tool for exploring some of these connections. It’s been incredibly rewarding. Not only has writing brought many of my wrong ideas to light, but it refined my process for constructing an investment portfolio. I now have an...

Read More »CSX Review 2020 – Digital Bank account by Credit Suisse

(Disclosure: Some of the links below may be affiliate links) CSX is a new digital bank account by Credit Suisse. They have just started this new offer in 2020. And this account is much cheaper than the standard Credit Suisse accounts. The CSX bank account can even be free if used correctly. Interestingly, even large Swiss banks are jumping on the digital bank account wagon. This is a good trend if that allows people to pay lower fees for their bank accounts. In this...

Read More »Diversification is important – Free lunch in Investing

(Disclosure: Some of the links below may be affiliate links) Diversification is often called the only free lunch in investing. It is a great way to reduce the volatility of a portfolio and sometimes increase its returns. You want to avoid having all your eggs in one basket. So, instead, you are going to use many baskets. The idea of diversification is mostly to invest in many companies and many countries. But there are other forms of diversification that we are...

Read More »Third Year of Blogging – The Poor Swiss is 3 years old!

(Disclosure: Some of the links below may be affiliate links) The Poor Swiss blog just turned three years old. It is difficult to believe it has already been three years since I started this blog. I have done a lot of things on this blog in the last year. Some of these things paid off. Some did not. But I think the blog is in a much better place right now than one year ago, which is always a good sign. I hope you agree with me! This article is a retrospective of this...

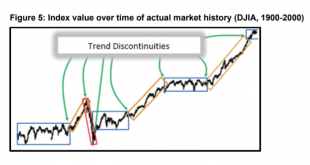

Read More »Retirement Income Planning Truth with Jim Otar. Part 1.

Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected...

Read More »Consumer Mood Darkens On Employment Prospects

A Fed survey of expectations shows that the consumer mood darkens on employment and job prospects. Job Transitions This chart shows the changes in employment status of respondents who were employed four months ago. The Fed survey asks individuals currently employed (excluding self-employment) whether they are working in the same job as when they submitted their last survey. If in the past four months they have answered that they now work for a different employer,...

Read More »Zak vs Neon: Best Swiss digital bank account in 2020?

(Disclosure: Some of the links below may be affiliate links) Zak and Neon are two good Swiss Digital bank accounts. They are both entirely digital and accessible through mobile applications. The great thing about these bank accounts is that they are significantly cheaper than conventional bank accounts. Their low prices are what make their success. And they have some attractive features. But which one should you choose? Which of Zak vs Neon is better for you? Let’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org