With the development of the Austrian Business Paradigm and the Austrian Business Model, and tools such as the “Value Learning Process,” businesses of all kinds can utilize the deep insights of Austrian economics to further enhance how they facilitate value for their customers. John Boles — an avid listener of the Economics for Entrepreneurs Podcast — provides an example of how he applies these insights at his accounting firm. Here is a summary resource and a...

Read More »Rich Millennials Plot the End of Civilization

[unable to retrieve full-text content]The New York Times managed to find some young people whose silver spoons provide a sour taste in their mouths. To hear them talk, their good fortune is making them sick.

Read More »Pelosi’s “Mandate”: What “Consent of the Governed” Really Means

The 2020 election failed to live up to the projections of many pollsters and Democratic strategists . The predicted landslide failed to materialize, and the Democrats lost seats in the House. This means in 2022 the Democrats will be defending a razor-thin majority in the House—a majority they’re almost certain to lose in a mid-term election if Biden is the final victor. The Democrats did well. But not that well. Nonetheless, Nancy Pelosi, in the days following the...

Read More »Feudalism and Cronyism in Machiavelli’s Italy

[Editor’s Note: This is a selection from “On Political Power and Personal Liberty in The Prince and The Discourses” from the spring 2014 issue of Social Research.] Although liberty is a recurring concern in Machiavelli’s writings, there is no consensus regarding either the definition of the concept or its relevance for his overall political thought. One direction of Machiavellian interpretation that has gained prominence in recent decades has focused on the concept...

Read More »Mises Explains the Santa Claus Principle

[From “The Exhaustion of the Reserve Fund” in Human Action, chap. 36.] The idea underlying all interventionist policies is that the higher income and wealth of the more affluent part of the population is a fund which can be freely used for the improvement of the conditions of the less prosperous. The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. Every measure is ultimately justified by...

Read More »The American Revolution Was a Culture War

Two hundred and forty-seven years ago this month, a group of American opponents of the Crown’s tax policy donned disguises and set about methodically destroying a shipment of tea imported into Boston by the East India Company. The vandals trespassed on privately owned ships in Boston Harbor and threw the tea into the ocean. These protesters were thorough. Not content with having destroyed most of the company’s imported tea that night, the activists later discovered...

Read More »Individualism and the Industrial Revolution

[Marxism Unmasked (2006)] Liberals stressed the importance of the individual. The 19th-century liberals already considered the development of the individual the most important thing. “Individual and individualism” was the progressive and liberal slogan. Reactionaries had already attacked this position at the beginning of the 19th century. The rationalists and liberals of the 18th century pointed out that what was needed was good laws. Ancient customs that could not...

Read More »What Is the Great Reset? Part I: Reduced Expectations and Bio-techno-feudalism

The Great Reset is on everyone’s mind, whether everyone knows it or not. It is presaged by the measures undertaken by states across the world in response to the covid-19 crisis. (I mean by “crisis” not the so-called pandemic itself, but the responses to a novel virus called SARS-2 and the impact of the responses on social and economic conditions.) In his book, COVID-19: The Great Reset, World Economic Forum (WEF) founder and executive chairman Klaus Schwab writes...

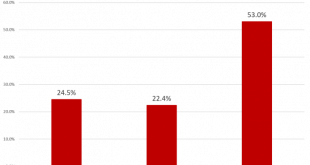

Read More »It Should Shock Us That There’s Any Consumer Price Inflation at All

Thanks to lockdowns, high unemployment, and general uncertainty and fear over covid-19, the personal saving rate in the United States in October was 13.6 percent, the highest since the mid-1970s. This is down from April’s rate of 33.7 percent, which was the highest saving rate recorded since the Second World War. Moreover, among those who received “stimulus” checks under the CARES Act, only 15 percent of those surveyed in a National Bureau of Economic Research (NBER)...

Read More »Trump’s NDAA Veto Threat Should Force a Conversation on Defense Spending

A dirty secret of congressional military spending is that when the government allocates billions in spending, unnecessary, wasteful, and parochial interests quickly find their way into the legislation. Original Article: A dirty secret of congressional military spending is that when the government allocates billions in spending, unnecessary, wasteful, and parochial interests quickly find their way into the legislation. That’s part of the reason President Trump...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org